文|哈希派 LucyCheng

Lucy Cheng.

2014年2月末,Mt.Gox因85万枚比特币不知所踪被迫暂停所有交易活动,受此影响比特币价格直接跌去36个百分点;两年后,规模近乎可以与前者媲美的黑客事件再次发生,Bitfinex交易所惊现安全漏洞,导致平台119756 BTC被盗,造成比特币当日超25%的跌幅。而现如今,Mt.Gox已永久载入历史,但同样遭受重创的Bitfinex却依旧活跃在主流交易所之列。

At the end of February 2014, Mt. Gox was forced to suspend all trading activities for 850,000 bitcoins, which affected the price of bitcoins by 36 percentage points; two years later, the same size as the hackers of the former reoccured, and the Bitfinex Exchange revealed a security gap, leading to the theft of platform 11756 BTC, resulting in an over 25% drop in Bitcoin on the day. Now, Mt. Gox is permanently in history, but Bitfinex, which has also suffered the same damage, remains among the mainstream exchanges.

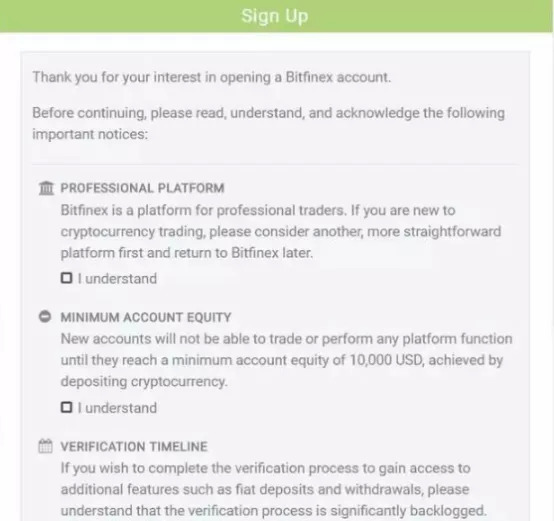

注册Bitfinex交易账户时弹出的说明(截图源自:Bitfinex官网)

Note from when registering Bitfinex trading account (extract from: Bitfinex network)

不同于其他交易平台致力于拉用户、吸引流量的做法,Bitfinex刚开始的入场门槛就颇高。不仅一上来就给你一条“劝退预警”——平台认证很慢,如果想要存款取款,认证需要六到八个星期的时间才能完成;还对用户的入场资金以及活跃度有着一定要求。根据官网的忠告显示,用户至少得有1万美元才能进入交易;另外如果注册后放着不进行交易的话,还要交付不活跃费。

Unlike other trading platforms that are committed to pulling users and attracting traffic, Bitfinex’s entry threshold is high. Not only does it give you a “no warning” – the platform’s certification is slow, and it takes six to eight weeks for a deposit to be made; there is also a requirement for user access funds and activity. According to advice from the network, users have to have at least $10,000 to enter the transaction; and, if there is no transaction after registration, they have to pay the inactivity fee.

但即便是有着这些严苛的要求,Bitfinex仍然吸引了大量的用户的入场。在2018年以前,平台几乎垄断了整个新兴的比特币交易市场。有交易专家认为,这是其提供P2P保证金交易服务的结果。但这家红极一时的交易所背后,也充斥着大量的争议以及黑料。

But even with these demanding requirements, Bitfinex attracted a large number of users. By 2018, the platform had almost a monopoly on the entire emerging Bitcoin trading market.

先是早年间出现的两次大型盗币事件,其中故事开头提到的那次黑客攻击造成了当时七千多万美元的损失,相当于平台用户近36%的资产。不过后来Bitfinex通过发行名为BFX的债权代币巧妙地化解了危机。虽然最开始的时候,很多人质疑代币赔偿只是缓兵之计,Bitfinex并没有赔偿的意愿;但代币发行半年之后,该交易所成功赎回了所有的BFX代币,彻底解除了此次事件的债务危机。

First, there were two large-scale currency thefts in the early years, in which the hacker attack referred to at the beginning of the story caused the loss of more than $70 million at the time, equivalent to nearly 36% of the assets of platform users. But then Bitfinex solved the crisis cleverly by issuing a debt in exchange called BFX.

截图源自:Coinmarketcap

from: Coinmarkcap

然而黑客盗币事件只是Bitfinex暗黑历史上的冰山一角,其频频出问题的法币通道以及与USDT之间暧昧不明的关系,也给领域陆续带去不少暴雷事件。2017年Bitfinex被匿名网友指控凭空发币且操纵市场,2018年平台多次传出与传统银行合作关系中断的消息;到了2019年,Bitfinex直接被纽约总检察长办公室告上法庭,称其使用Tether的资金秘密弥补平台8.5亿美元的损失。但就像之前的被盗事件一样,Bitfinex似乎每次都能逢凶化吉、起死回生;顶着黑料与骂名,继续发行平台币LEO、积极入场1EO市场且持续活跃在加密货币交易市场。

However, the hacking of currency was only the tip of the iceberg in the dark history of Bitfinex, with problematic French currency access and unclear relations with the USDT, and a number of thunderstorms. In 2017, Bitfinex was accused by anonymous online users of giving currency in an empty space and manipulating the market, and in 2018 the platform was repeatedly reported to have interrupted its partnership with traditional banks; in 2019, Bitfinex was brought to court by the New York Attorney General’s Office, claiming that he was using Tether’s funds to cover the loss of $850 million. But, as in previous thefts, Bitfinex seemed to have been able to react to murder, death, and death.

不过经历过如此多的危机时刻之后,部分用户对Bitfinex的信任度已大幅下降;据官方公布的数据显示,早前纽约总检察长办公室控告Bitfinex期间,平台用户至少从交易所撤出3万枚比特币以及100万枚以太坊。而且随着领域各交易所竞争越发激烈,Bitfinex在全球交易平台的排名已跌至50名以后。

However, after so many times of crisis, some users’ confidence in Bitfinex has declined significantly; according to officially published data, during an earlier indictment by the New York Attorney-General’s Office against Bitfinex, the platform’s users withdrew at least 30,000 bitcoins and 1 million eetha from the exchange. And, as competition between exchanges in the field has intensified, Bitfinex’s ranking in the global trading platform has fallen to after 50.

表面上看来,Bitfinex对市场的影响力已大大减弱;但不要忘记的是,目前占据着全球65%以上交易量的USDT与Bitfinex之间存在着不言而喻的密切联系。

On the face of it, Bitfinex’s influence on the market has diminished considerably; however, it should not be forgotten that there is a self-evident close link between the USDT and Bitfinex, which currently account for more than 65 per cent of global transactions.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论