作者:@DistilledCrypto

@DistilledCrypto

編譯:深潮Tech Flow

This post is part of our special coverage The New York Times (CC BY-NC-SA 2.0).

什麼時候流動性會湧入市場?

When does strong get into the market?

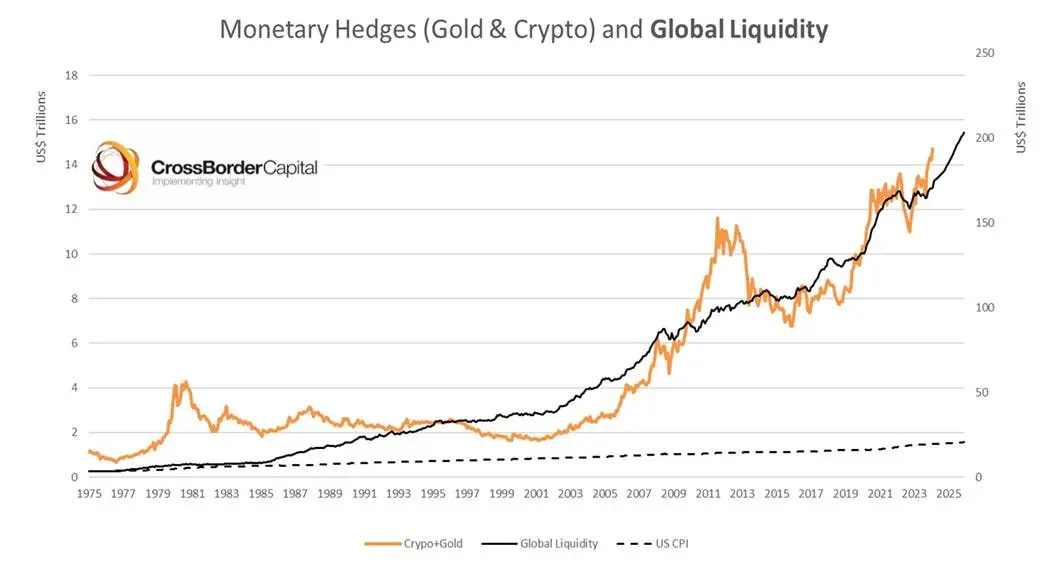

歸功於流動性,更多的錢進入通常意味著更高的加密貨幣價格。

Thanks to fluidity, more money enters the usually higher price of encrypted currency.

然而,目前市場仍乾涸,2021年的「上升潮」蹤影全無。

However, the market is still drying up and the "up" of 2021 is missing.

我考究了宏觀專家CG(@pakpakchicken) 的見解以探索一些線索。

I looked into the views of the macrologist CG (@pakpakchicken) to explore some clues.

受政策影響

is influenced by policy

@pakpakchicken每天花數小時追蹤政策變化,“政策驅動流動性,流動性驅動資產,資產驅動GDP...等等”

@pakpakchicken spends several hours a day tracking policy changes, “Policy drive, flow drive, asset drive GDP, etc.”

他的結論是:最大的風險源自於上行。

His conclusion is that the greatest risk comes from going ahead.

@CryptoHayes和@RaoulGM也同意這一點。

@CryptoHayes and @RaoulGM agree with this.

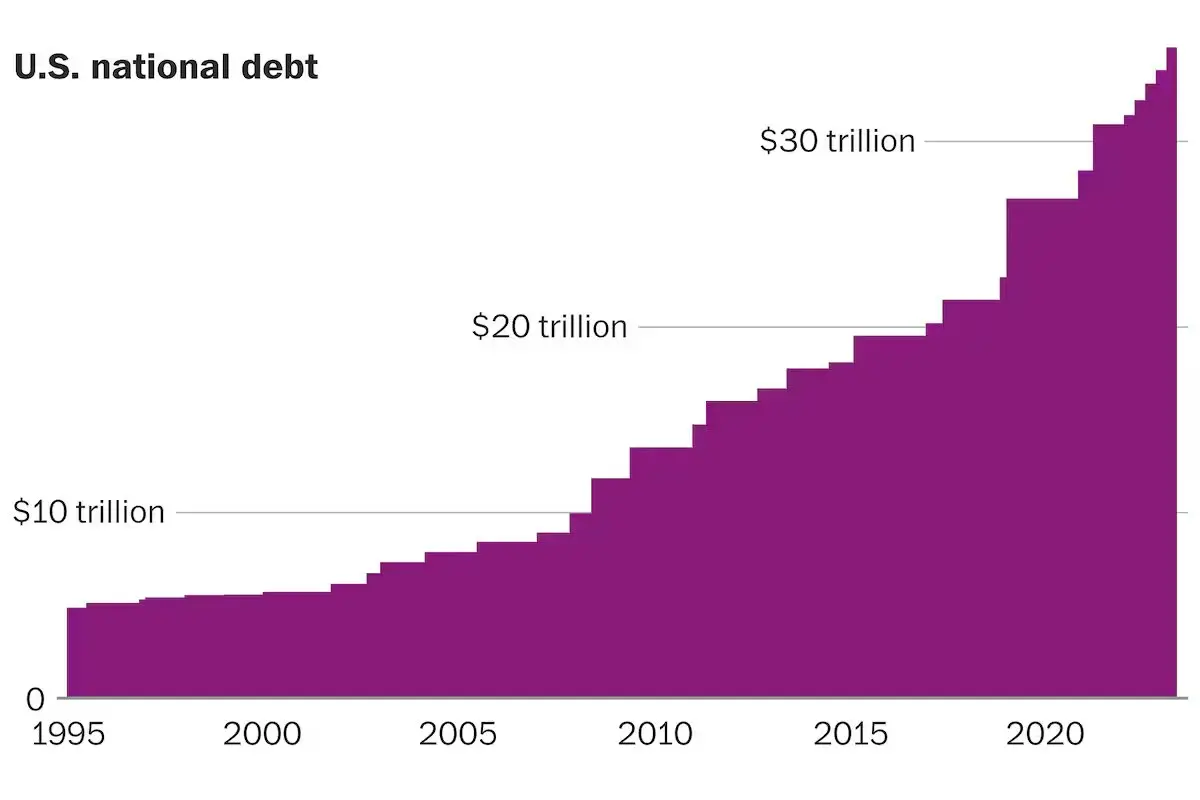

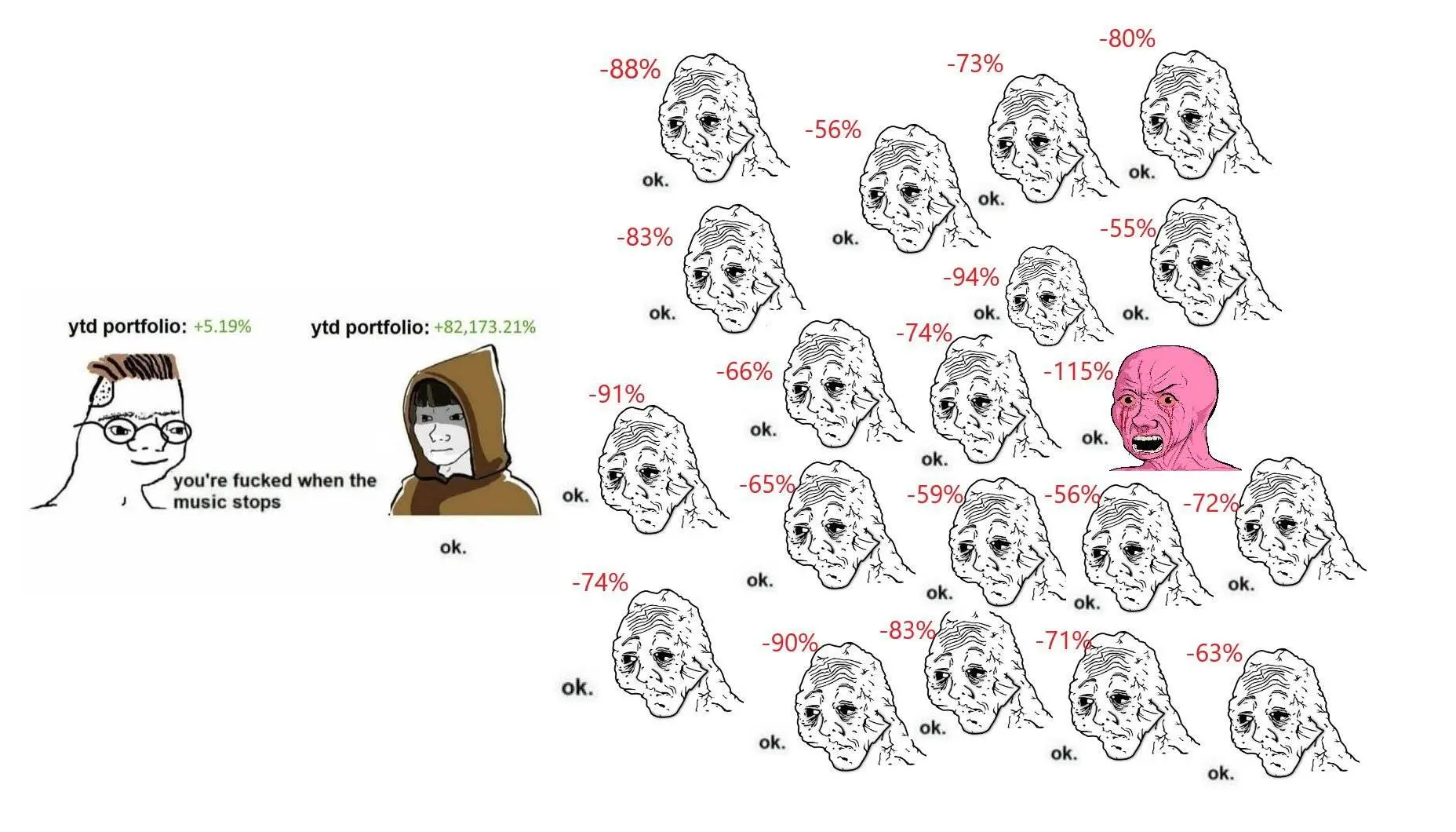

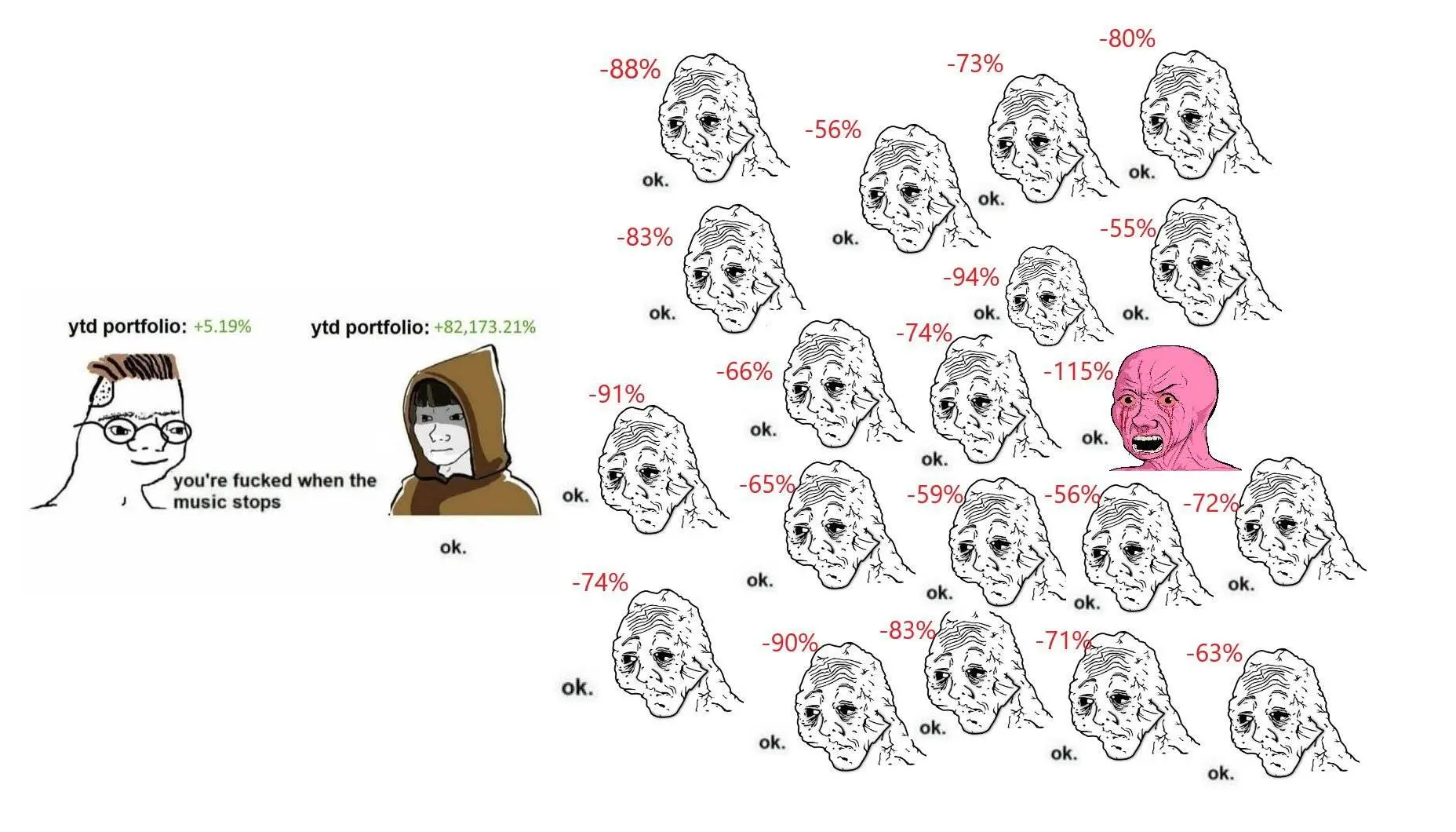

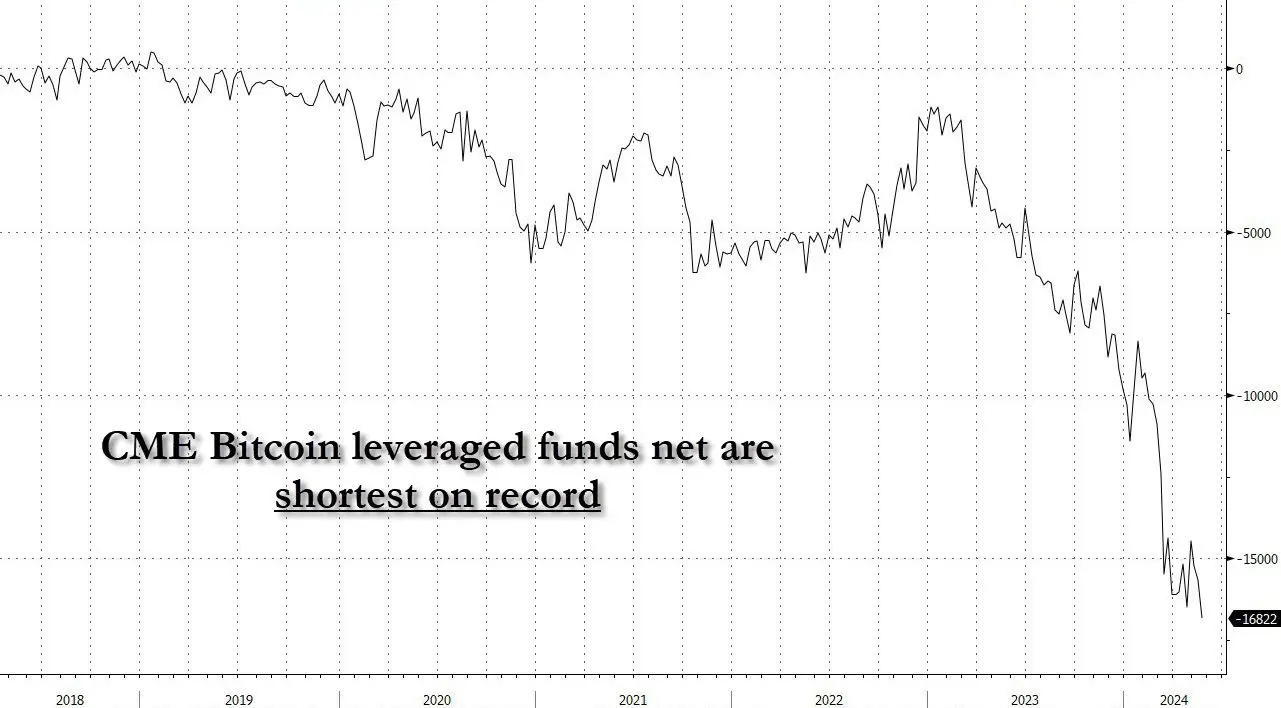

一個被忽略的見解

@pakpakchicken指出,很少有人討論美元可能走弱這一預期。 @pakpakchicken points out that there is very little discussion about the possible weakening of the dollar. 他預測未來將有一個協同步調來貶值美元,這項舉措可能會增加流動性。 He predicted that in the future there would be a synchronized shift to devalued dollars, which could increase mobility. 作為故事背景,回顧1985 年的事件 1985年前後的政策背景將有助於理解政策制定者的心態: The policy context after 1985 will help to understand the mindset of policymakers: → 緊縮的貨幣政策 • Condensed currency policy → 高長期利率 • High and long-term interest rates → 強勢美元(探究「奶昔理論」) ♪ Power dollar ♪ → 高赤字 High deficit 前所未有的波動 隨著波動性季節的臨近, @pakpakchicken預測將會出現極端的動盪。 As the season of motion is approaching, predicts extreme events. 這將由美國需要償還35兆美元債務的需求所驅動。 This will be driven by the need for the US to pay back 35 trillion dollars in debt. 為什麼波動性是好事 @pakpakchicken認為波動性並不是缺陷,而是獲利的理想特徵。 argues that wave activity is not a flaw, but rather an ideal for profit. 大量的錢是在短期的爆發中賺到的。 A lot of money was earned in the short run. 橫盤震盪會將普通投資者甩出局,而市場會在你放棄時迎來上漲。 The whirlwind will throw out ordinary investors, and the market will rise when you give up. 債務對加密貨幣的影響 The impact of debt on encrypt currency 為了管理其巨額債務,美國可能會增加流動性以貶值貨幣。 In order to manage its huge debt, the United States may increase its liquidity to devalue its currency. 這將確保債務展期是可控的,如果沒有這些調控措施,收益率可能會失控。 This would ensure that debt extensions are manageable and that without these controls, the rate of return could be out of control. Larry Fink 的觀點 Larry Fink's point of view 貝萊德CEO Larry Fink談到國家債務時提到: When the CEO Larry Fink said: 無論美國如何增加稅收或削減債務,這些措施都不足以解決國家債務問題。因此,他強調建設新的基礎設施至關重要。他認為,透過建設新的基礎設施,不僅可以促進經濟成長,還可以為未來的發展奠定基礎。 These measures are not enough to solve the country’s debt problem, regardless of how the US increases its tax revenues or reduces its debt. He therefore stressed the importance of building new infrastructure. He argued that building new infrastructure would not only boost economic growth, but also lay the foundation for future development. CG( @pakpakchicken ) 認為,在美元仍保值的情況下,機構將會把一切資產進行代幣化。 The CG () believes that the institution will monetize all assets while the dollar remains in place. CG的宏觀更新(Q2晚期) macro-update (Q2 late) 第二季末,美國每週流動性支援每次操作高達20億美元,QT從每月60億美元減少到25億美元。 At the end of the second season, the United States was running two billion dollars a week, and QT was reduced from $6 billion to $2.5 billion a month. 美國政策加大短期票據發行力度,同時中國人民幣可能迎來貶值。 U.S. policy has increased short-term issuance of tickets, while the Chinese renminbi is likely to be devalued at the same time. 中國數萬億人民幣的流動性成長可能有利於加密貨幣,隨著商品、服務和資產價值的通貨緊縮,貨幣貶值迫在眉睫,這些因素都預示著下半年的潛在看漲。 the movement of hundreds of billions of Chinese renminbi may be beneficial for encryption currency, which is imperiled by the contraction of goods, services and asset values, all predicting a potential increase in the second half of the year. 美國公債回購 {\bord0\shad0\alphaH3D}America public debt {\cHFFFFFF}{\cH00FFFF} {\cHFFFFFF}{\cH00FFFF} buy back {\cHFFFFFF}{\cH00FFFF} {\cHFFFFFF}{\cH00FFFF} 自5月29日開始的美國國債回購,每週流動性支持回購激增至20億美元,這種流動性注入可能會在混亂的選舉季節放大加密貨幣價格。 CG( @pakpakchicken ) 認為2024 年下半年可能會上升勢頭。 CG () believes that the situation may increase in the second half of 2024. 指數級Summer @pakpakchicken致力於將加密貨幣作為領先的資產類別然而,他強調:「市場保持非理性的時間可能比你保持償付能力的時間長。」全球流動性激增的未來正在路上... 敘事疲勞 CG( @pakpakchicken ) 強調敘事理解是關鍵。 CG() stressed that the understanding of the story was key. 敘事驅動市場,直至敘事的價值耗盡。 The word drives the market until its value is exhausted. CPI/通貨膨脹敘事正在減弱;最近的報告缺乏影響力。 CPI/inflational narratives are decreasing; recent reports lack influence. 下一個主流焦點 隨著銀行準備金的動搖,就業成為焦點,降息比預期更早。 As the bank prepares its gold, it becomes a focus and reduces interest rates earlier than expected. TLDR:“保持長期持有” TLDR: “Maintain long-term holding” 最痛苦的市場趨勢 隨著宏觀力量的匯聚,按照市場規律CG 預計會出現「最痛苦的市場走勢」 "A href="https://x.com/DistilledCrypto/status/180393531620373247" rel="noformlow"" PS: 「最痛苦的市場走勢」是金融市場中的一個概念,直譯為「最大痛苦」,指的是市場在某一特定時期內採取的價格變動路徑,這種路徑通常會給大多數投資者帶來最大的痛苦和困擾。 這個概念背後的邏輯是,市場往往會選擇使得多數投資者虧損放大的價格走勢,而這種市場行為背後的驅動力包括市場操縱、機構投資者的策略以及市場內在的供需關係。 The logic behind this concept is that markets tend to choose price movements that magnify the losses of the majority of investors, and the driving forces behind such market behaviour include market manipulation, institutional investor strategies, and supply and demand in the market. 走向「最痛苦的市場走勢」之前會經歷哪些徵兆 What are the signs of the most painful market developments before /strange'? 零售業尚未做好上漲準備 The retail industry is not ready to go up. 許多有影響力的人稱市場已見頂 A lot of influential people say the market is over. 做市商做空 I'm a salesman. I'm a salesman. 壓倒性的看跌頭寸 It's just that it's just... it's... it's just... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... it's... 最終的結果是很有可能迎來大幅上漲。 In the end, it is likely that there will be a substantial upturn. 下注$ETH bets on $ETH CG( @pakpakchicken )認為$ETH會在上漲週期中脫穎而出。 CG () believes that $ETH will slip away during the last week. 如Larry Fink 指出,從長遠來看,債務是不可持續的。 As Larry Fink pointed out, debt is unsustainable in the long run. 雖然美元有價值,但一切都將轉型過渡和代幣化。 While the United States dollar is valuable, everything will be converted over time and monetized. 只有一個L1經受住了時間的考驗,並且迄今為止擁有最高的採用率——即ETH Only one L1 has been tested for time and has so far had the highest rate of use, the ETH. 尊重機率 雖然CG( @pakpakchicken ) 傾向於上漲,但進一步下跌並不是不可能。 宏觀專家@fejau_inc將經濟成長放緩看作基本面,他認為目前存在自2019年以來未見的重大下行意外風險。 Although the CG () is leaned toward upwards, a further decline is not impossible. The thinker @fejau_inc views economic growth as a fundamental aspect, arguing that there are significant downside risks that have not been seen since 2019.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论