K线图是股市中最常用的技术分析工具之一,它可以帮助投资者了解股票的价格走势,从而做出投资决策。日K、周K、月K是K线图的三种常见类型,它们各有特点,适合不同时间周期的投资者使用。本文将为您介绍日K、周K、月K的图解分析方法,帮助您更好地理解K线图。

The K-line is one of the most commonly used technical analysis tools in the stock market, which helps investors understand stock price trends in order to make investment decisions. Day K, Week K, and Month K are three common types of K-line maps, which are unique and suitable for investors with different time cycles. This paper will provide you with an overview of day K, week K, month K, and help you better understand the K-line.

日K线图

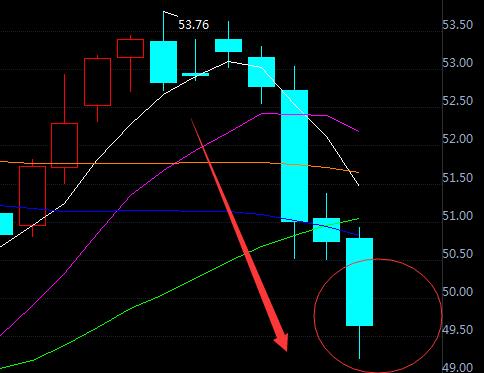

日K线图是记录股票一天的价格变动情况的图表。它由实体和影线两部分组成。实体代表的是开盘价和收盘价之间的差距,影线分为上下影线,上影线代表最高价和收盘价之差;下影线代表最低价和开盘价之差。

The Japanese Kline is a chart of the price movements of the stock for one day. It consists of both the entity and the film line. The entity represents the difference between open and closed prices, which are divided into top and bottom lines, which represent the difference between top and bottom; and the bottom line, which represents the difference between the lowest and opening prices.

日K线图的分析方法

The method of analysis of the K-line map of

- 看涨形态:

- 阳线:收盘价高于开盘价,实体部分越长,涨势越强。

- 光头阳线:实体部分没有下影线,表示多方势力强大,股价有上涨趋势。

- 锤子线:实体部分较小,下影线较长,表示空方势力试图打压股价,但失败了,股价有反弹趋势。

- 看跌形态:

- 阴线:收盘价低于开盘价,实体部分越长,跌势越强。

- 光脚阴线:实体部分没有上影线,表示空方势力强大,股价有下跌趋势。

- 十字线:实体部分很小,上影线和下影线都很短,表示多空双方势均力敌。

周K线图

K-line map

周K线图是记录股票一周的价格变动情况的图表。它与日K线图的分析方法基本相同,但需要注意的是,周K线图可以反映股票短期内的趋势,因此适合短期投资者使用。

The weekly K-line chart is a chart that records stock price movements for a week. It is basically the same as the Japanese K-line analysis, but it needs to be noted that the weekly K-line map reflects stock trends in the short term and is therefore suitable for short-term investors.

月K线图

月K线图是记录股票一月的价格变动情况的图表。它与日K线图、周K线图相比,可以反映股票中长期的趋势,因此适合中长期投资者使用。

The monthly K-line chart is a chart of the price movements of the stock in January. It reflects the medium- and long-term trends of the stock compared with the Japanese K-line map and the weekly K-line map, and is therefore suitable for use by medium- and long-term investors.

月K线图的分析方法

The method of analysis of the K-line map of

- 看涨形态:

- 三白兵:三个阳线,且每根阳线的收盘价都高于上一根阳线的最高价,表示多方势力强大,股价有上涨趋势。

- 上升通道:股价沿着上升趋势线运行,表示股价有上涨趋势。

- 看跌形态:

- 三黑鸦:三个阴线,且每根阴线的收盘价都低于上一根阴线的最低价,表示空方势力强大,股价有下跌趋势。

- 下降通道:股价沿着下降趋势线运行,表示股价有下跌趋势。

K线图是股市中重要的技术分析工具,它可以帮助投资者了解股票的价格走势,从而做出投资决策。日K、周K、月K是K线图的三种常见类型,它们各有特点,适合不同时间周期的投资者使用。投资者应根据自己的投资需求和风险承受能力,选择合适的K线图类型进行分析。

K-lines are an important technology analysis tool in stock markets that helps investors to understand stock price trends and thus make investment decisions. Day K, Week K, and month K are three common types of K-line maps that are unique and suitable for investors with different time cycles. Investors should select the right K-line type for analysis based on their investment needs and risk tolerance.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论