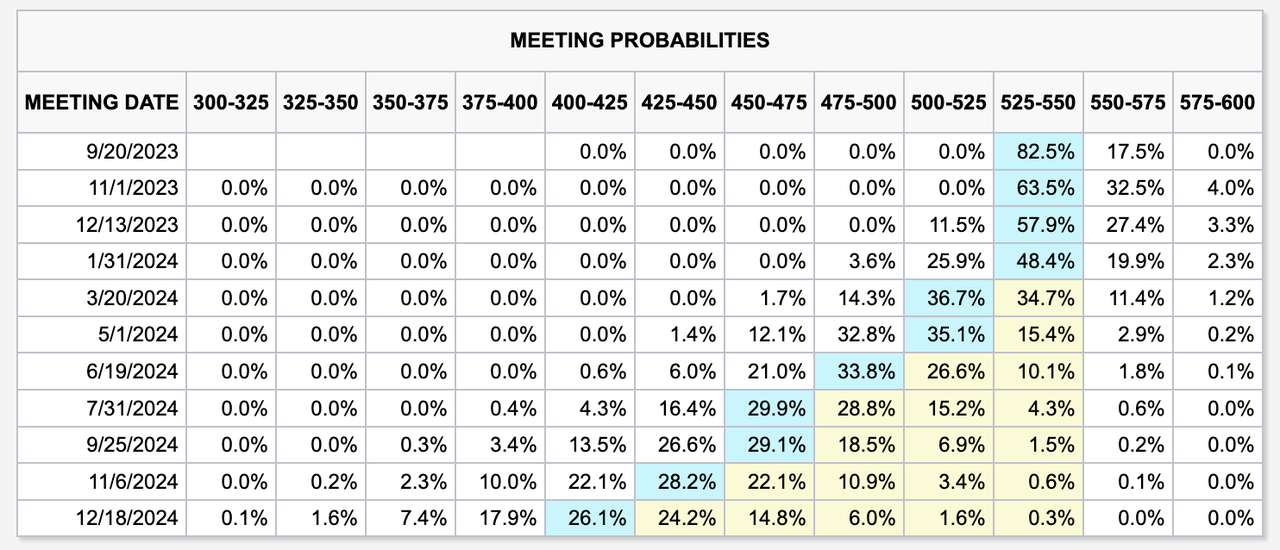

7月的美聯儲利率決議可能是歷次美聯儲利率決議中懸念最小的一次。25個基點的加息並沒有超出任何人的預期,而鮑威爾通常的鷹派講話也並未帶來更多新意。“進一步加息”只會在經濟數據出現顯著過熱的情況下才會發生;而在獲得支持“顯著過熱”論的數據之前,“維持高利率”是更爲可能的解決方案。5.25%以上的利率水平至少會持續至2024年3月,在5月後纔有降息的可能。

The US Federal Reserve interest rate decision in July may have been the lowest in the US Federal Reserve. The 25 basis points raise did not exceed anyone’s expectations, and Powell’s usual Eagle speech did not bring any new meaning. “Further increase” would occur only when the economy’s data appeared to be overheating; and “higher interest rates” would be a more likely solution until data in support of the “overheat” theory had been obtained. More than 5.25% interest rate levels would last at least until March 2024, with the possibility of reducing interest rates after May.

當然,進一步加息的可能性也在一定程度上被定價。利率市場的數據顯示,交易員們預期美聯儲利率有近30%的可能再進行一次25bps的加息。這種擔憂並不無道理:實時通脹數據顯示,在經歷了連續一年的通脹下行後,7月中旬,在以食品、住房、交通爲代表的生活必需品價格反彈的影響下,整體通脹水平開始觸底反彈——這意味着再通脹的概率並不是0。美聯儲的政策放鬆可能會重蹈70年代通脹控制失敗的覆轍;因此,無論出於何種考慮,鮑威爾都不會輕易考慮降息相關事項。

Of course, the possibility of a further increase is also somewhat priced. The market data for interest rates show that traders expect nearly 30% of the US Federal Reserve rate to increase 25bps again. This concern is not unreasonable: real figures show that, after a consecutive year of traffic, in mid-July, when the prices of food, housing, transport, and essentials for life rebounded -- which means that the probability of re-dipulation is not zero. US Federal Reserve policy easing could repeat the failure of control in the 1970s.

美聯儲利率變動可能路徑,截至2023年8月2日。來源:CME Group

美國實時通脹數據情況,截至2023年8月2日。來源:Truflation.com

美國食品通脹數據情況,截至2023年8月2日。來源:Truflation.com

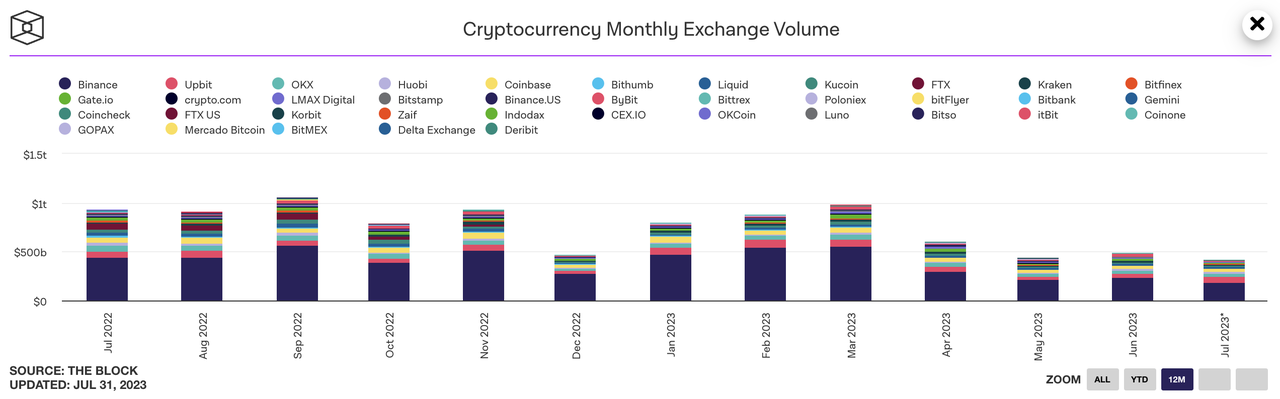

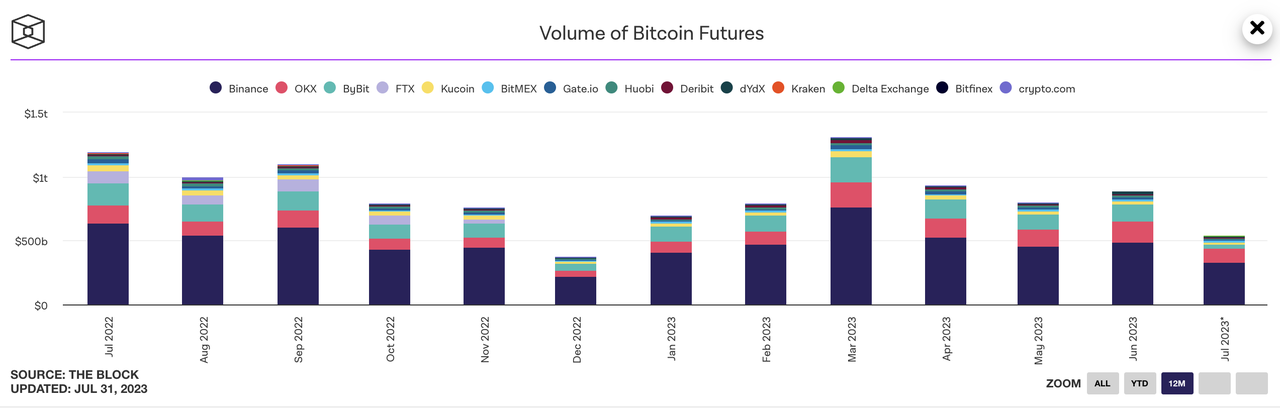

對於加密市場而言,投資者們似乎已經習慣了在高利率下的日常。缺乏流動性使得投資者們對於“交易”缺乏興趣。大多數投資者們都在觀望;7月的加密市場現貨成交量甚至低於聖誕節期間,而 BTC Delta 1 合約的成交量也只是略好於聖誕節與新年。看起來加密市場是有“暑假”的。

For the encryption market, investors seem to be used to the day-to-day situation at high interest rates. Lack of mobility makes investors less interested in “trading.” Most investors are watching; in July, the encrypt market was even lower than during Christmas, and the BTC Delta 1 contract was only slightly better than Christmas and New Year.

加密市場現貨月成交量變動情況。來源:The Block

比特幣 Delta 1 合約月成交量變動情況。來源:The Block

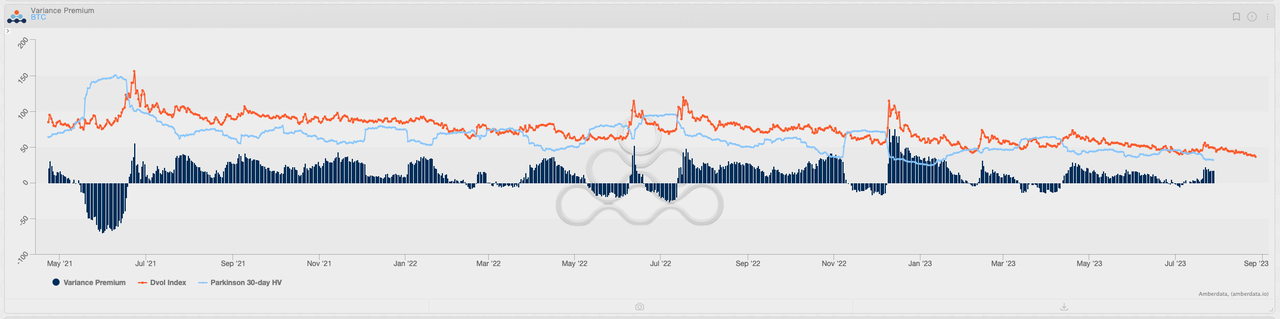

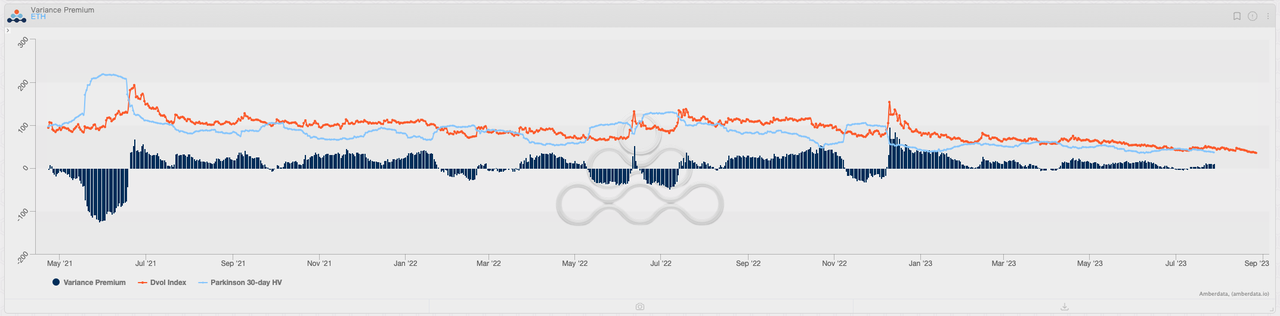

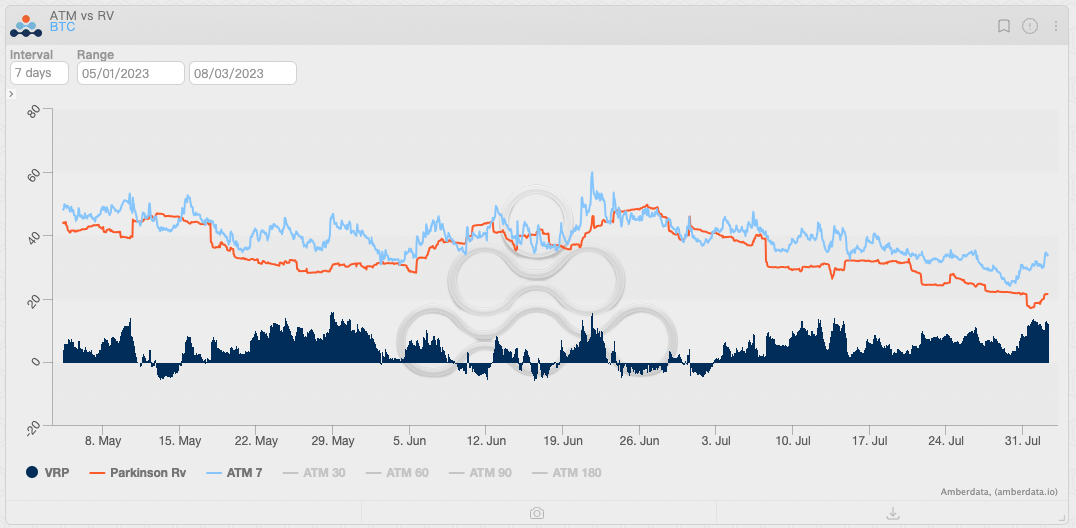

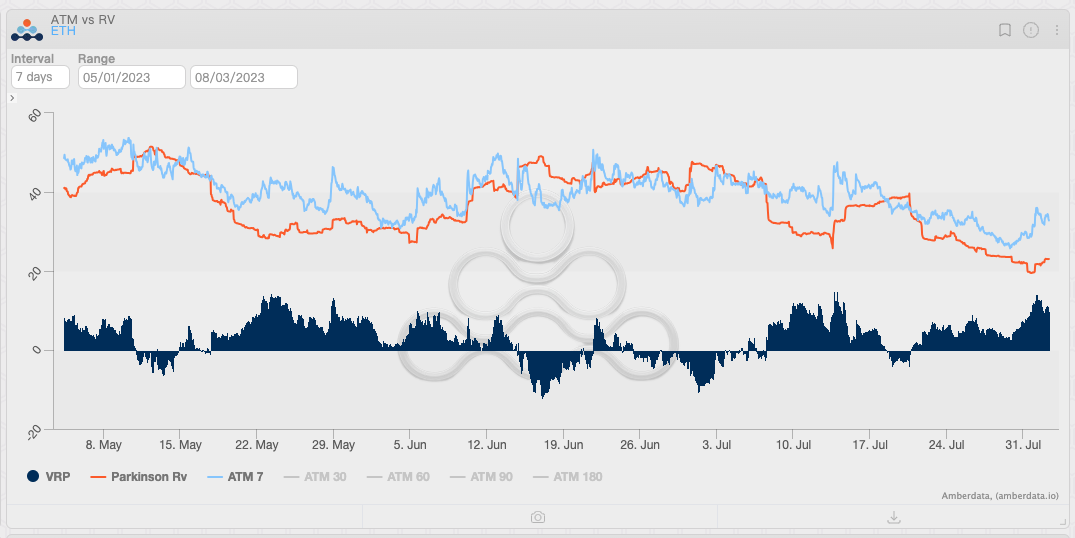

“暑假”意味着低波動。BTC 與 ETH 的波動率指數(DVOL)打破了2年以來的新低,而即使在這種創紀錄的低波動率預期下,期權賣方仍然可以獲得收益,這意味着市場的實際波動水平仍然顯著低於預期。在2021年,幾乎不會有人考慮 BTC 日內價格變動幅度低於1%的情形;而在2023年年中,低於0.1%的波動已經成爲了加密市場的日常。

The BTC and ETH's wave rate index (DVOL) have broken down for two years, and even with this record low wave rate forecast, the current rights seller is still reaping benefits, meaning that the market's actual wave level is still significantly lower than expected. In 2021, hardly anyone would have considered BTC's daytime price movements of less than 1 per cent; and in 2023, a wave of less than 0.1 per cent had become the day-to-day movement of the encrypted market.

/

BTC 與 ETH 波動率指數變動。來源:Deribit

BTC 與 ETH 方差溢價變動。來源:Amberdata Derivatives

同樣,由於觀望情緒瀰漫與低波動,加密投資者對於利率的敏感程度已經不再那麼顯著。即使鮑威爾與拉加德再進行1-2次加息,也只是“在珠穆朗瑪峯上更進一步”——流動性狀況不會再壞到哪裏去。很多“聰明錢”早已離開,但沉澱下來的流動性並不會輕易離開加密市場,爲加密貨幣提供了必要的價格支撐。然而,這些流動性通常並不活躍:從加密市場市值變動數據來看,從3月中旬至今,加密市場的總市值已經在1.2萬億美元附近徘徊了超過4個半月的時間。

Similarly, the sensitivity of encryption investors to interest rates is no longer so obvious because of the mood and low waves of watching. Even one or two additional interest hikes between Powell and Lagarde are simply “a step further on Everest” – the fluidity is not going to get any worse. Many of the “smart money” has already left, but the sunk fluidity does not easily leave the encrypted market, providing the necessary price support for the encrypt currency.

加密市場總市值變動情況。來源:CoinMarketCap

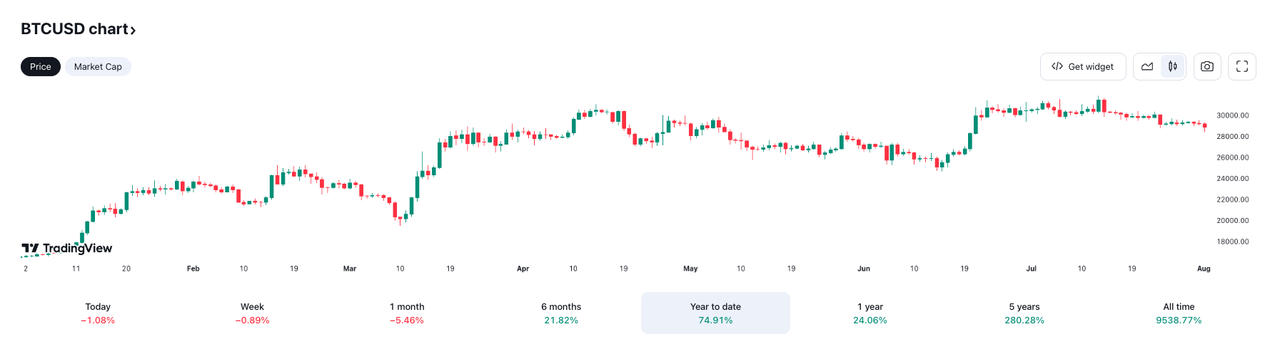

如果對比近幾個月的價格數據,亦不難發現:在 BTC 價格位於3萬美元附近、ETH 價格位於2,000美元附近的時候,兩者均會在此失去進一步向上的動力,徘徊一段時間後轉頭向下。觸及兩個價位的時間或短或長,但進一步的價格突破並未出現。似乎在這兩個價位附近存在着一個無形的天花板,阻擋着加密資產的上行步伐。

If you compare the price figures of recent months, it is also not difficult to find: when the BTC price is close to $30,000 and the ETH price close to $2,000, both lose further momentum and move back and down for a while. The time or time to touch the two prices is short or long, but a further price breakthrough does not occur. It seems that there is an invisible ceiling around these two prices, blocking the ups and downs of encrypted assets.

2023年年初至今 BTC 與 ETH 價格變動情況。來源:Blofin.com

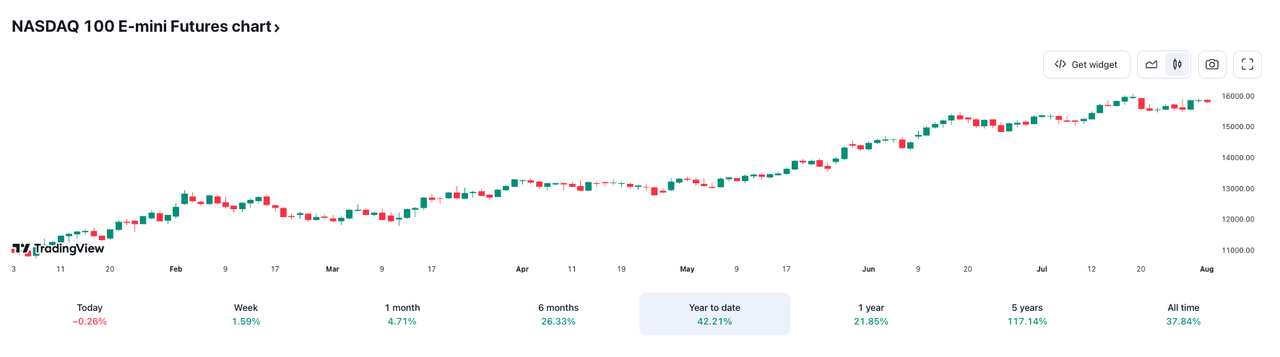

流動性水平的變動是“加密天花板”形成的重要原因之一。在高利率下,貨幣市場基金展現出了相對更高的吸引力,而美股(特別是納斯達克指數中所包含的科技股)亦成爲了加密市場的有力競爭對手。BTC 上漲帶來的超額收益似乎只集中在年初,而在隨後的6個月裏,BTC 的表現已經顯著落後於納斯達克指數。

The shift in fluidity levels is one of the main reasons for the formation of the “encrypted ceiling.” At high interest rates, the currency market fund has shown a relative higher appeal, and the US share (especially the technology shares contained in the Nasdak index) has become a strong competition for encryption. The excess gains from the BTC upturn appear to be concentrated only at the beginning of the year, and in the next six months the BTC’s performance has become apparent at the lower end of the Nasdak scale.

在此情形下,對於散戶而言,加密貨幣所帶來的造富效應已經在部分程度上不敵美股;這意味着多數散戶在加密市場中更傾向於“保持沉默”。考慮到散戶通常傾向於做多,散戶的缺位使得加密市場缺少了重要的上漲動力來源。

In this case, the efficiency of the encrypt currency is already partly non-enemy; this means that most dispersed people tend to be “silenced” in the encrypt market. Considering that the bulk is usually tending to do more, the absence of the dispersed makes the encrypt market an important source of uplifting.

2023年年初至今納斯達克指數與BTC價格變動,來源:Tradingview

From the beginning of 2023 to the present, Nasdak's index and BTC's price have changed. Source: Tradingview

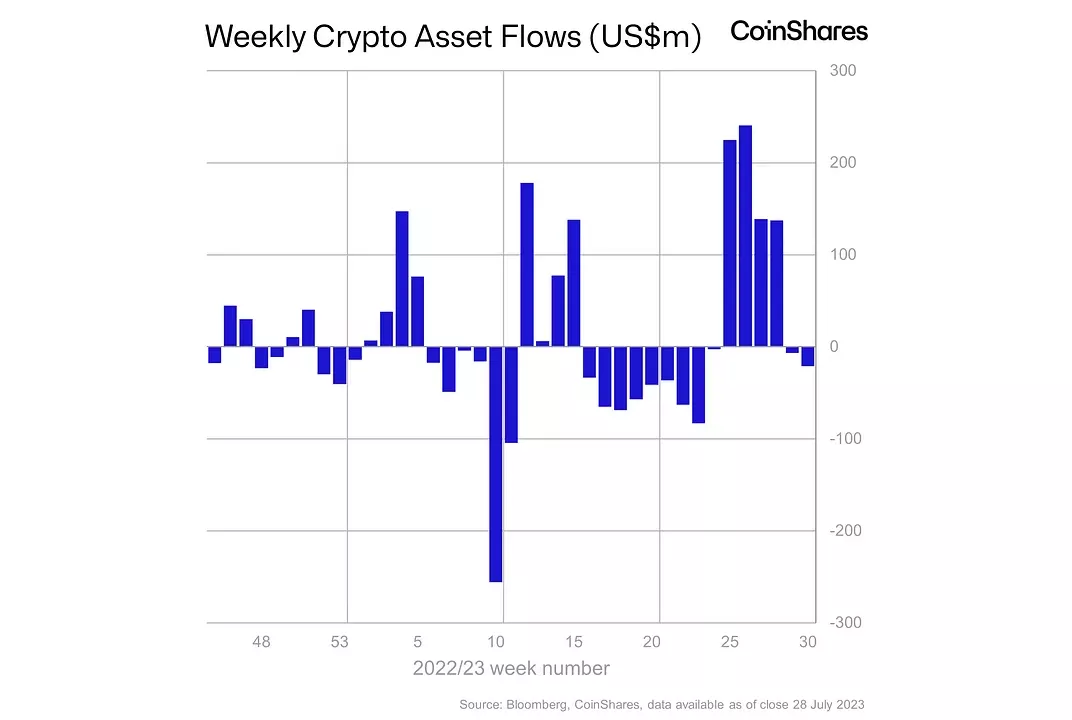

機構投資者的行爲則更加耐人尋味。回顧2023年年初至今的加密基金資金流向,不難發現,機構投資者們的行爲有着顯著的“潮汐”特徵:在加密市場出現短暫大幅上漲時,機構資金紛紛涌入;而在市場傾向於平靜的時刻,機構資金便開始流出。

Looking back at the flow of encrypted funds from the beginning of 2023 to the present, it is easy to see that the actions of the institutional investors have a remarkable “tidal” feature: when there is a short and massive rise in the encryption market, there is an influx of institutional funds; and when the market tends to be calm, it starts to flow.

近一年來加密基金每週資金淨流入/流出情況,來源:CoinShares

某種程度上,機構的行爲模式有些類似於0 DTE 交易者:傾向於從價格的短暫變動中獲利,而非從市場週期變動中獲利——這被稱之爲“Gamma 效應”。在“Gamma 效應”的影響下,在價格上升至特定價格水平後,機構會傾向於賣出,而在價格下跌至某個水平後,機構則會轉向買入。儘管上述行爲爲加密資產價格提供了強有力的支撐(特別是在考慮到機構在流動性提供者中的地位的時候),但機構的觸發賣出行爲,無疑使得“加密天花板”變得更加厚實。

To a certain extent, the agency’s pattern is similar to that of a zero DTE trader: it tends to profit from a temporary change in prices rather than from a change in the market period – which is called the “Gamma effect.” Under the influence of the “Gamma effect”, institutions tend to sell, but when the price falls to a certain level, institutions turn to buy. Although the above-mentioned industry offers strong support for the price of encryption (especially when considering the institution’s position as a dynamic provider), the institution’s incentive to sell makes the “encrypted ceiling” more robust.

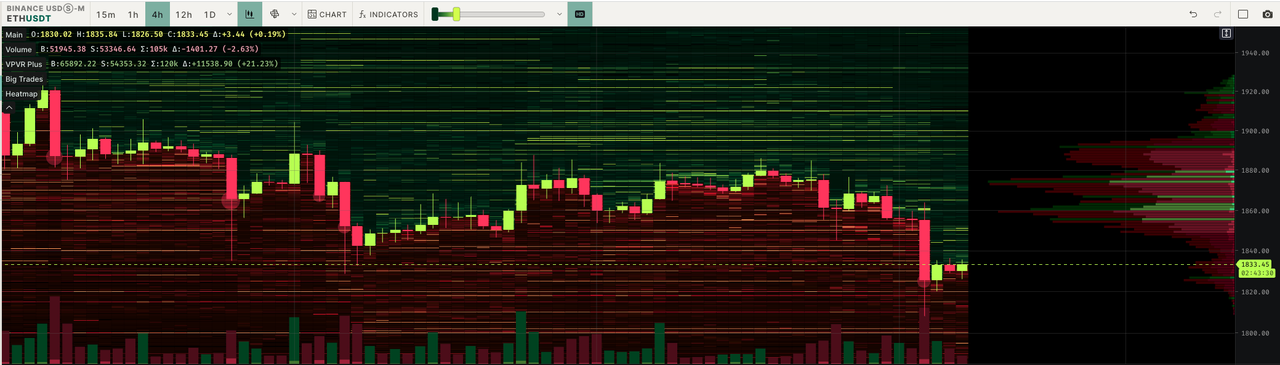

VPVR (Volume Profile Visible Range,成交量可視範圍) 數據爲“Gamma 效應”提供了更多的證據支撐。以 BTC 爲例,在30,000美元附近,賣單佔據主導地位,以紅色顯示;而在29000美元附近,呈現出明顯綠色的部分,買單則佔據主導地位。在 ETH 上,亦存在着類似的買單和賣單分佈。

VPVR (Volume Profile Visible Range, Visible Range) provides additional evidence support for the Gamma Effect. In BTC, for example, in the vicinity of $30,000, sales orders take the lead in red; in the vicinity of $29,000, purchase orders take the lead. On ETH, there are similar purchase orders and sales orders.

BTC 與 ETH 永續合約 VPVR 數據變動。來源:Tradinglite

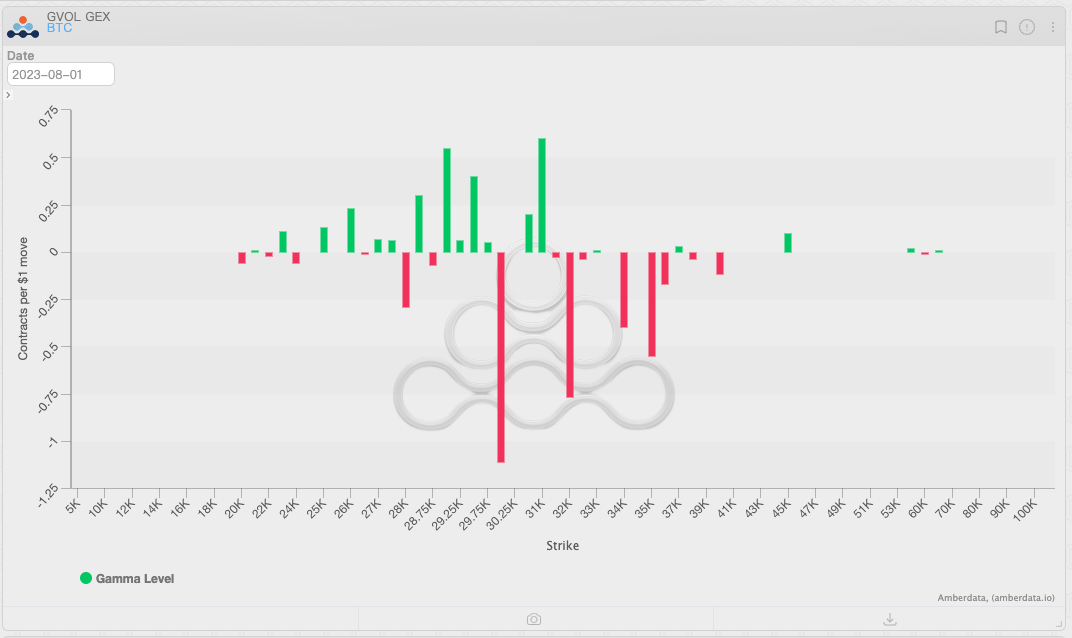

做市商的對衝行爲則是支撐“加密天花板”的另一個因素。對於期權做市商而言,在正 gamma 執行價附近,爲維持 delta 中性,做市商通常採取“高拋低吸”的策略,而在擁有負 gamma 的執行價附近則相反。在正 gamma 爲主的市場中,做市商往往會在價格上升時拋售他們的 delta 庫存,對價格形成壓制——這正是這幾周正在發生的事情。

The market is another factor that supports the “encrypted ceiling.” For futures, in the vicinity of the positive gamma enforcement, marketers tend to adopt a “high drop and low” strategy in order to maintain the neutral character of delta, and in the vicinity of the negative gamma enforcement. In the Gamma-owned market, marketers tend to sell their delta deposits at a time when prices are rising, putting pressure on prices – which is what is happening in these weeks.

考慮到在投資者交易熱情不高的時刻,做市商是爲數不多的活躍交易者羣體之一,做市商爲平衡風險敞口而進行的對衝行爲,使得價格的上升之路變得愈發“舉步維艱”。

Considering that the market is one of the few active traders at a time when the investor's trade is less intense, the marketer's counter-offer to balance the risk exposure has made the price escalation path increasingly “hard”.

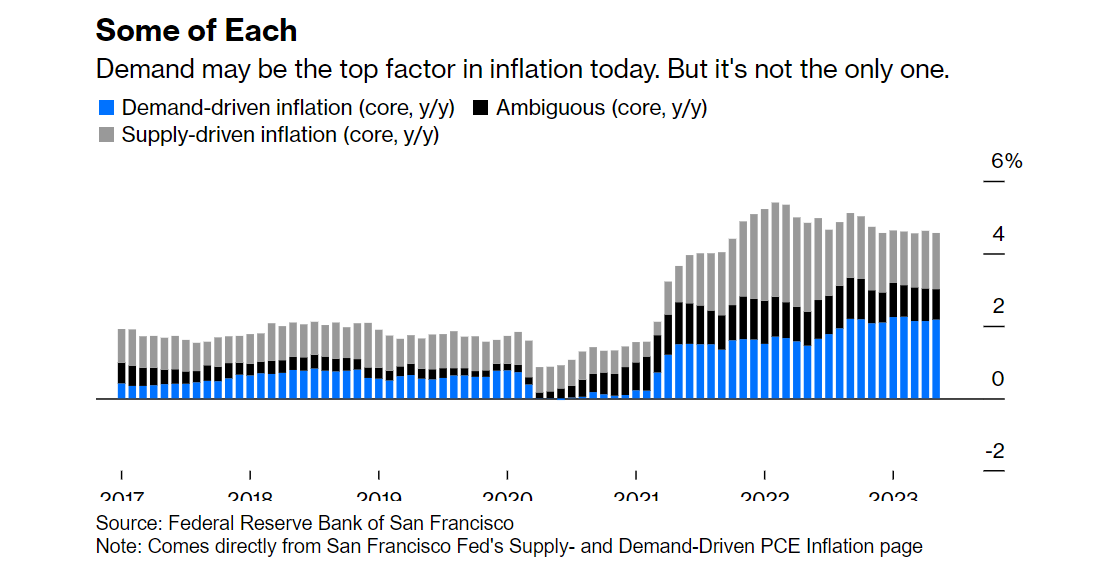

然而,持續的低波動並不意味着尾部風險不會發生。對於加密市場而言,來自宏觀的潛在風險依然不能忽略。 However, the continued low wave activity does not mean that the tail risks do not occur. For the encryption market, the potential risks from ambition are still to be ignored. 從經濟數據來看,美國經濟數據與就業表現超預期強勁,而隨着供應鏈緊張問題的完全緩解,“相對過熱的”需求可能已經成爲了主導通脹的因素。上述情況意味着,爲徹底壓制通脹,美聯儲可能會對需求端進行進一步管理。美聯儲的經濟學家們是“經濟增速限制論”的信徒;他們相信,超過這個限制就會過熱,並可能引發通脹。 According to economic data, the US economy’s economic data and employment performance are exceeding expectations, and with the complete easing of supply chain tensions, the demand for “overheated” may have become a dominant factor. This means that the US Federal Reserve may be able to manage the demand side even further in order to shut down the traffic altogether. 因此,對於美聯儲而言,採取超預期行爲(如再次加息或延長利率頂峯期),甚至通過引發短暫衰退來達到通脹目標,並不是不可接受的選項;但對於加密市場而言,這意味着進一步的流動性壓力。 Thus, it is not an unacceptable option for the US Federal Reserve to take an over-expected approach (e.g. to raise or extend interest rates again) or even to reach a transitory target by triggering a short recession; but for the encrypted market, this would mean further fluid pressure. 此外,太平洋西岸的動作亦不容忽視。作爲金融市場中的主要流動性提供者之一,日本央行長期以來通過“收益率曲線控制”(YCC)魔法,爲“渡邊太太”們提供着源源不斷的資金。不過,隨着日本內部通脹壓力加大,日本央行已經不願如此大方;他們放鬆了對 YCC 的控制——這意味着流動性政策轉變的開始。要知道,日本央行釋放的流動性並不只是分佈在傳統市場;BTC 與 ETH 正在迎來額外的風險。 As one of the major liquidity providers in the financial market, the Central Bank of Japan, through the “YCC” magic, has long provided a source of money for the Watanabe Mrs. Watanabes. However, as Japan’s internal pressure has increased, the Central Bank of Japan does not want to be so generous; they relax its control over YCC – which means the beginning of a shift in dynamic policy. 當然,加密市場內部也可能是尾部風險的來源。Curve 事件的發生已經引發了一些投資者的擔憂,而類似事件通常難以被考慮在預期之內。同時,監管部門並未因爲對 XRP 訴訟失利而停下腳步;SEC 仍在試圖將 BTC 以外的其他代幣納入監管範圍。上述的“額外事件”恰恰是我們需要防範的對象;在獲得 theta 收益時買入一定的尾部保護仍是必要的。 Of course, the inner part of the encryption market may also be the source of tail risks. The events in Curve have caused concerns among some investors, and similar events often cannot be considered as expected. In the meantime, the Department of Oversight has not stopped for the loss of profit against the XRP; the SEC is still trying to put in custody money other than the BTC. The above-mentioned “extra-events” are precisely what we need to guard against; and it is still necessary to buy some tail protection when the ta gains are made. 綜上,在安度暑假的同時,我們仍然需要在一定程度上保持警惕。幸運的是:上述的幾件事件發生概率不會太大,而即使發生,在8月發生的概率則更爲渺小。8月是不錯的休假時節;在賣出波動率的同時,付出一些必要的成本,做好尾部保護即可。讓我們一起享受 theta 帶來的“歡樂時光”。 At the same time as summer vacations, we still have to be somewhat vigilant. Fortunately, the probability that these events will occur is not too high, and even if they do occur, the probability that they will occur in August is even smaller. August is a good holiday; at the same time that the wave rate is sold, the necessary costs are paid and the tail is protected. Let's enjoy the “happy hour” brought by the ta together.

2023年5月至今 BTC 與 ETH VRP 數據變動,來源:Amberdata Derivatives

2017年至今通脹主導因素佔比變動,來源:舊金山聯儲

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论