在数字货币市场中,套利交易是一种常见且有效的盈利方式。特别是稳定币如USDT,由于其在多个交易平台上具有相对一致的价值和高流动性,为套利者提供了理想的操作对象。本文将介绍一种基于USDT的跨平台搬砖套利策略,帮助投资者在波动的市场环境中寻找稳定的利润来源。

In the digital money market, arbitrage is a common and efficient method of profitability. In particular, stable currencies such as the USDT, which provide a desirable target for arbitrators because of their relative consistency and high mobility on several trade platform. This paper will describe a USDT-based cross-platform brick arbitrage strategy to help investors find a stable source of profits in a volatile market environment.

USDT(Tether)是一种与美元挂钩的加密货币,旨在提供数字货币的稳定性。其价值设计上与美元保持1:1的比例,这使得它成为交易者在极端市场波动时避险的工具。

The USDT (Tether) is an encrypted currency pegged to the dollar to provide stability in digital currency. Its value is designed to be at a 1:1 ratio to the dollar, which makes it a tool for traders to avoid exposure to extreme market fluctuations.

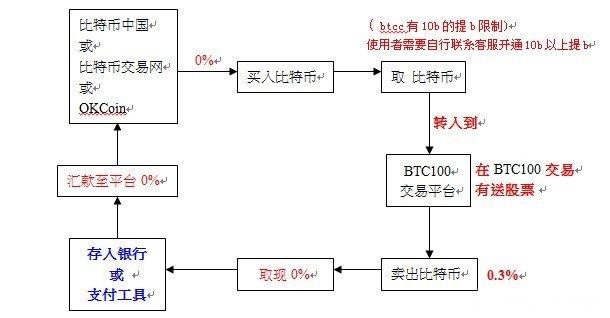

跨平台搬砖套利的核心在于利用不同交易所之间相同资产的价格差异。具体到USDT,虽然其价值理论上是固定的,但由于供需关系、交易费用、提现限制等因素,不同交易所的USDT价格会有细微的差异。通过在一个平台买入低价的USDT,然后在另一个平台卖出高价的USDT,可以实现无风险的利润。

The core of cross-platform brick transfer arbitrage is the price differential between the same assets

发表评论