文? | 棘轮 比萨

Wen, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee, wee.

“如果有一天USDT崩盘,结局将会如何?”在预言中悬了太久的那只靴子,落地了。

"If one day the USDT crashes, what will happen?" The boot that hanged for too long in the prophecy fell to the ground.

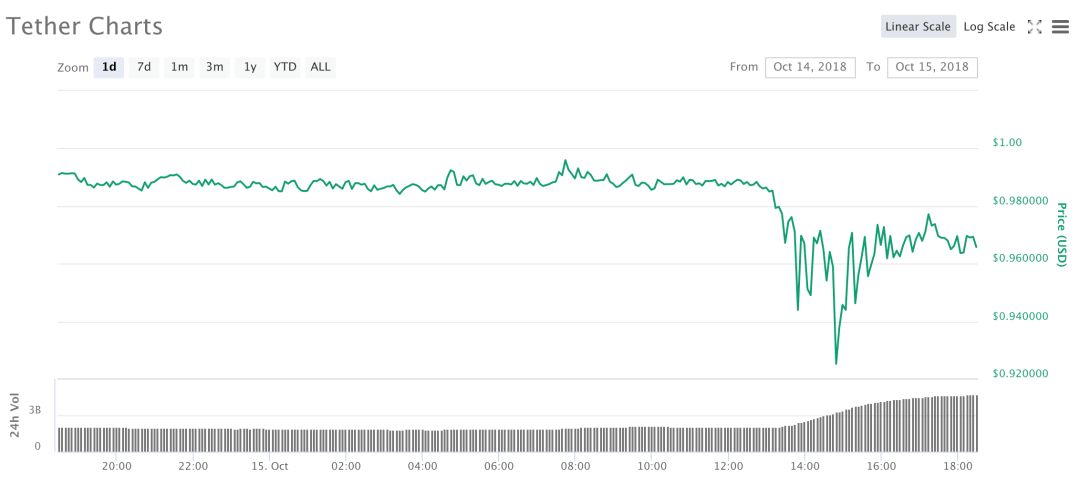

10月15日下午,惊心动魄的一刻出现了。运行已有5年之久的USDT,在2小时内,暴跌8%。

On the afternoon of October 15, an exciting moment appeared. The USDT, which had been running for five years, fell by 8 per cent in two hours.

受此影响,主流数字货币对USDT价格普遍暴涨。但没人敢轻易将其换成USDT止盈,因为这样做了,很可能手里最后只是一串无用的代码。

As a result of this, mainstream digital money has generally surged against the USDT price. But no one dares to switch it to USDT, because in doing so, it is likely to end up with just a bunch of useless codes.

USDT此次暴跌的原因何在?它将改变行业的哪些生态?这场危机是否会给其他稳定币带来新的机会?

What is the reason for the USDT’s collapse? Which ecology will it change in the industry?

01?困兽之斗

"01?" "B," "B," "B," "B," "B," "B," "B," "B," "B," "B," "B," "B," "B," "B," "B," "B."

“USDT崩了!”

"USDT crashed!"

短短2小时内,USDT暴跌8%,令人瞠目结舌。

In just two hours, the USDT plunged by 8 per cent, giving me the creeps.

小幅下跌是从今天早晨7:44开始的。很快,市场信心开始崩溃,大量USDT被抛售,换成比特币、ETH、瑞波币,甚至各类平台币。

A small drop began at 7:44 this morning. Soon, market confidence began to collapse, and a large number of USDTs were sold into bitcoin, ETH, Ripoco, and even various forms of platform currency.

发行USDT的Tether公司,一直承诺以1:1比例兑付美元。但今天,USDT价格最低时,甚至不足0.9美元。作为最主流的稳定币,这在USDT的历史上,堪称破天荒。

The company Tether, which issues USDT, has been committed to paying the dollar at a 1:1 ratio. Today, however, USDT prices are lowest, even below $0.9.

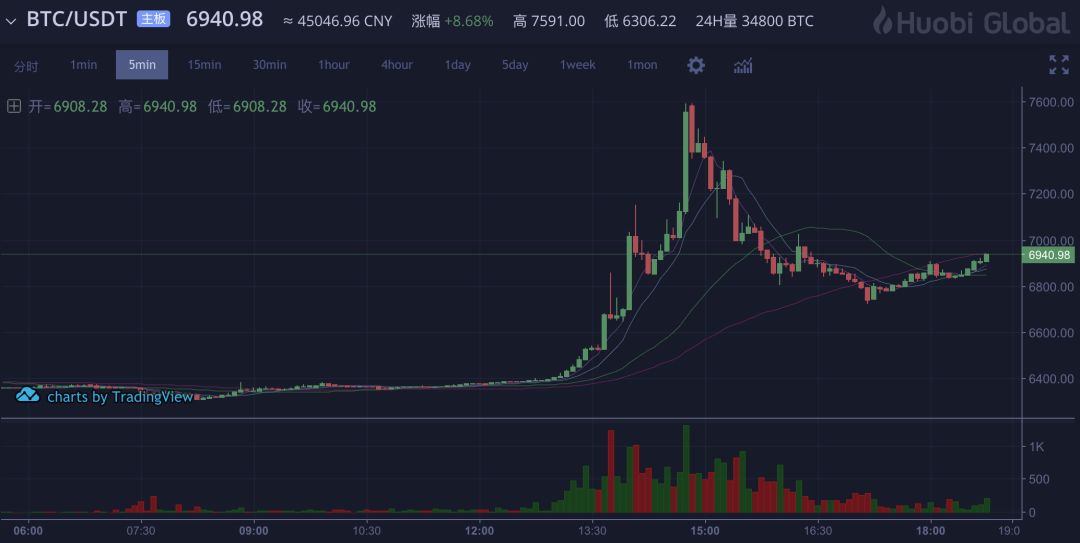

恐慌在下午达到顶点。13:00起,主流数字货币对USDT价格全线上涨,涨幅大多超过10%。

The panic peaked in the afternoon. From 13 p.m., the mainstream digital currency rose by more than 10 per cent over the entire USDT price.

实际上,大多数币种的“币价上涨”,都来自USDT的暴跌——如果以人民币、美元等法币折算,多数币种的币价,依然保持恒定。

In fact, the “currency price rise” in most currencies is the result of a sharp fall in the USDT — most currencies remain constant if converted in French currency such as the renminbi, the United States dollar and so on.

但是,对于比特币、ETH等主流币种而言,其币价仍然出现了真实的上涨。今日下午,比特币价格一度触及7600 USDT高位,上涨18%,远高于USDT的跌幅。

But for mainstream currencies such as Bitcoin, ETH, etc., the price of the currency has actually risen. Today afternoon, bitcoin prices hit a high of 7,600 USDT, up 18%, well above the fall of the USDT.

USDT是最主流的稳定币,本应被视作“避险资产”,但它反而成为了风险点。这一场面,极具戏剧性。

USDT is the most mainstream currency of stability and should have been considered a “risk-free asset”, but it has become a risk point. This scene is dramatic.

非常时刻,多个交易所暂停了USDT的充币、提币功能。

At the very moment, several exchanges suspended the USDT charger, puller function.

9:59,KuCoin交易所称,因USDT钱包系统维护,暂停USDT的充值和提现功能。14:08,这一功能恢复。

At 9:59, the KuCoin transaction stated that the USDT charging and lifting functionality was suspended as a result of the USDT wallet system maintenance. At 14:08, this function was restored.

14:05,币易暂停USDT充币功能,称恢复时间将另行通知,但提币和交易不受影响。

At 1405 hours, the currency could easily suspend the USDT charge function, stating that the recovery time would be notified separately, but that the withdrawal of the currency and the transaction would not be affected.

此外,主流币种对USDT价格的上涨,导致大量期货平台空单被爆。

In addition, the rise in the price of USDT in the mainstream currency led to the explosion of a large number of futures platforms.

14:00后的半小时内,币Coin数据显示,OKEx上的大额爆仓单成交了4062万USDT,其中比特币爆仓2887万USDT,ETH爆仓1426万USDT,EOS爆仓1039万USDT。

In the half hour after 1400, Coin data showed that the large explosion manifests on OKEx had been paid for US$ 4062 million, of which US$ 2887 million went off in Bitcoin, USD 14.26 million in ETH and USD 10.39 million in EOS.

同期获利的做多者,以主流币种为代价,换得了大量存在继续贬值风险的USDT。

Most of the profits during the same period were made at the expense of mainstream currencies, replacing a large number of USDTs with a risk of continued devaluation.

在USDT价格反弹后,他们成为了这场血洗最大的赢家。

After the USDT price rebounded, they became the biggest winner of this bloodbath.

02?阴谋

{\bord0\shad0\alphaH3D}Conspiracy

USDT危机的爆发,并非一日之寒。

The outbreak of the USDT crisis was not a cold day.

2015年,USDT诞生。其发行方Tether公司承诺,为USDT设立银行准备金账户——所有的USDT,都有等量的美元法币作为担保。

In 2015, the USDT was born. The issuer, Tether, promised to set up a bank reserve account for USDT — all USDTs are guaranteed in equal quantities in French dollars.

如果Tether公司所言属实,则USDT安全无虞。

If Tether is telling the truth, the USDT is safe and secure.

然而,Tether可能并没有守住底线。相比于1:1地发行USDT,无节制超发,显然能让Tether赚到更多的钱。

However, Tether may not be holding the bottom line. The unbridled excess of hair, compared to the 1:1 release of the USDT, clearly allows Tether to earn more money.

没有人能承受“币圈印钞机”的暴利诱惑。

No one can stand the temptation of a money-printer.

为了洗脱嫌疑,Tether委托律师事务所出具透明性报告,试图自证清白。然而,这份报告却让Tether受到了更多的质疑。

In order to escape suspicion, Tether commissioned a transparent report from the law firm in an attempt to prove his innocence. However, the report gave Tether more questions.

该报告仅保证,Tether在2018年6月1日当日,可为所有流通USDT提供等额美金担保,却无法证明6月1日之前、之后,USDT同样具备等额担保资质。

The report merely assured that, on 1 June 2018, Tether would be able to provide an equivalent dollar guarantee for all United States dollars in circulation, but could not prove that the same level of collateral was available before and after 1 June.

此外,报告出具方——FSS律师事务所,无法保证所有数据基于标准会计准则计算,报告本身也不能被视作正式的审计结果。该律师事务所还表示,事务所合伙人担任Tether某开户行顾问,与Tether间存在关联关系……

In addition, the issuer of the report, the FSS law firm, could not guarantee that all data were based on standard accounting standards and that the report itself could not be considered as a formal audit finding. The firm also stated that there was a link between the firm's partner, who was a consultant to a branch of an account in Teth...

Tether自身难保,为Tether提供资金托管服务的银行爆发破产危机,则更让其雪上加霜。

This was compounded by the bankruptcy crisis in the banks that provided Tether with financial hosting services, which was difficult to protect themselves.

本月初,彭博社报道,注册于波多黎各的Noble银行,受2018年的数字货币熊市影响,已濒临破产。目前,这家银行正以500-1000万美元的价格,寻求潜在的收购方。

Earlier this month, Bloomberg reported that the Puerto Rican-registered Noble Bank, affected by the 2018 digital currency bear market, was on the verge of bankruptcy. The bank was currently seeking potential buyers at a cost of $5-10 million.

公开资料显示,Tether与Bitfinex,是Noble银行最重要的两个客户。Tether口中为USDT提供等额美金担保的银行账户,就设在Noble银行。

Public sources indicate that Tether and Bitfinex are the two most important clients of Bank Noble.

但Tether与Noble银行之间的关系,不止于此。

But there is more to the relationship between Tether and Noble Bank.

Noble银行的实控人布罗克·皮尔斯(Brock Pierce),也是Tether的创始人之一。这两者之间的关系,就像Tether与Bitfinex一样,说不清,道不明。

The realist of Noble Bank, Brock Pierce, was one of the founders of Tether. The relationship between the two, like Tether and Bitfinex, was unclear and unclear.

因此,Noble银行濒临倒闭的消息,显然会引发外界对于USDT的恐慌。

Therefore, the news that Noble Bank is on the verge of collapse is clearly causing a panic in the USDT.

值得一提的是,近期关于USDT的负面消息,似乎全部出自一家媒体——彭博社。

It is worth mentioning that the recent negative news about USDT appears to have come from one media, Bloomberg.

在曝光Noble银行濒临倒闭的消息后,彭博社再次发文,称美国金融学教授格里芬(John Griffin)发现,Tether可以直接通过发行USDT的方式,操控比特币交易——2017年比特币的牛市,至少有一半功劳应归功于Tether。

After exposing the impending closure of Noble Bank, Bloomberg again wrote that US Professor of Finance John Griffin found out that Tether could control the Bitcoin deal directly through the release of USDT — at least half of the credit for Tether was due to Bitcoin's cattle market in 2017.

但事实上,格里芬的这篇论文早已在今年6月就对外公开发布。且早在今年年初,Medium上就有网友曝光了Tether与Bitfinex高管间关于超发USDT、拉高比特币价格的录音文件。

But, in fact, Griffin’s paper was published in the public domain in June this year. And early this year, Medium’s web users exposed audio files between Teth and Bitfinex executives about the over-exploited USDT, Lagobitcoin prices.

彭博社选择在这时炒USDT的冷饭,值得玩味。

Bloomberg's choice of a USDT cold meal at this time is worth playing.

昨日下午,彭博社继续发文,阐述为什么数字货币投资者会质疑USDT。今日12:30,彭博社最新文章援引一位区块链投资机构人士的话称,如今市面上已有多种稳定币可供选择,“有些人可能会抛弃USDT,转而支持GUSD或PAX。”

Yesterday afternoon, Bloomberg continued to send a message on why digital money investors would question USDT. Today, 12.30 p.m. Bloomberg’s latest article quotes a member of the block chain investment agency that there are now a number of stable currencies on the market, “some people may abandon USDT and support either USD or PAX.”

“这应该是一次有预谋的狙击战。”一位业内人士对一本区块链表示,“市场份额一共就这么大,其他稳定币若想登台唱戏,不撕USDT怎么上位?”

"It's supposed to be a premeditated sniping battle." One of the people in the industry said to a block chain, "This is the size of the market, and how do the rest of the stables not take up the USDT if they want to sing on stage?"

03?洗牌

"03?" "b" shuffling

“USDT会彻底崩盘吗?币市会因此彻底玩完吗?”USDT风雨飘摇的这天,市场上出现了种种疑问。

"Is there a complete collapse of the USDT? Is there a complete collapse of the currency market? "The day when the USDT is raining, there are questions in the market.

悲观者认为,USDT若出了问题,所有基于USDT报价的交易币种都有可能被重创,出现踩踏性的灾难。

Pessimists believe that any currency traded on the basis of USDT offers could be seriously damaged if there was a problem with the USDT, and that there was a stepping disaster.

与之相反,乐观者认为,这反而可能造就牛市——流入BTC等主流数字货币的资金,会因USDT的崩盘而变多。

On the contrary, optimists believe that this may, on the contrary, create cattle markets — funds flowing into mainstream digital currencies, such as the BTC, which will become larger as a result of the collapse of the USDT.

短期来看,第二种观点似乎暂时得到了应验。

In the short term, the second view appears to have been provisionally accepted.

而财经专栏作家殷浩天认为,这是一次短期内的暴跌,长期来看,USDT仍有生存空间。

And the financial columnist Yin Ho-Chung thinks it's a short-term collapse and, in the long run, USDT still has room for survival.

“因为Bitfinex和Tether的裙带利益关系,Bitfinex是不会让USDT这么轻易就死掉的。”殷浩天告诉一本区块链记者。

“Because of Bitfinex and Tether's nepotism, Bitfinex will not let the USDT die so easily.” Yin-ho told a block chain reporter.

事实上,Bitfinex“不差钱”。今年8月24日,BTC富豪榜排名第一的钱包地址,向1Kr6QSydW9bFQG1mXiPNNu6WpJGmUa9i1g地址,转出了10000枚比特币,仍有179501枚比特币剩余。而1Kr6开头的钱包地址持有13267枚BTC。

In fact, Bitfinex is “no bad money.” On August 24, this year, the BTC’s first-ranked wallet address was transferred to the address of 1Kr6QSydW9bFQG1mXiPNu6WpJGmUa9i1g, with 10,000 bitcoins and 179501 bitcoins remaining. The wallet address at the beginning of 1Kr6 holds 13267 BTCs.

知情人士透露,这两个地址均为Bitfinex的钱包地址,且此次转账为交易所内部钱包的互转。

Sources revealed that both addresses were the wallet of Bitfinex and that the transfer was an exchange's internal wallet.

“Bitfinex在牛市赚的钱就不止30亿美金,只要把这波挤兑潮扛过去了,USDT还会翻身的。”殷浩天说。

"Bitfinex earns more than $3 billion in cattle, and as long as the tide is over, the USDT will turn over." Yon-ho-ho.

他认为,Bitfinex有足够的资本度过这次危机。“哪怕拿出1亿美金,让这些短期套利者赚一波。” 殷浩天说。

In his view, Bitfinex had enough capital to survive the crisis. “Just give these short-term arbitrators $100 million to make a wave of money.” In the name of Ying Ho.

但经此一跌,毫无疑问,其他稳定币会抢占USDT的市场份额。

But with this fall, there is no doubt that other stable currencies will capture the market share of the USDT.

“KuCoin最近宣布和Gemni合作,今天就停止了USDT交易。”某行业人士告诉一本区块链记者。

“KuCoin recently announced cooperation with Gemni and today stopped the USDT deal.” A trader told a block chain reporter.

他认为,包括Gemini和Paxos推出的GUSD和PAX在内的其他稳定币,早就摩拳擦掌,准备拉USDT下马,自己上位了。

In his view, other stable currencies, including the GUSD and PAX introduced by Gemini and Paxos, had long been rubbing their hands, preparing to take down the USDT and taking up their seats.

可以预见的是,在未来的很长一段时间内,稳定币的江湖将迎来血雨腥风。

What can be foreseen is that, for a long time to come, the steady currency of the river will be in the throes of blood.

今日15:00之后,USDT开始走出颓势,价格重回0.94美元。受此影响,主流数字货币对USDT的价格开始回落,币市再次归于寂静。

Today, after 15 p.m., the USDT starts to get out of its slump, returning to the price of $0.94. As a result, mainstream digital currency prices for the USDT begin to fall and the currency market becomes silent again.

“有人恐慌性抛售USDT,有人逃亡场外,导致比特币暴涨。”一位投资者在微博写道,“过段时间回头看,这又是一次对韭菜们的收割。”

"Some people are panicking about selling USDT, some are on the run, causing Bitcoin to soar." One investor wrote on Twitter, "Looking back for a while, it's another harvest of pickles."

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论