比特币矿机是专为加密货币挖矿而定制的计算机。比特币矿工用于帮助处理交易并保护使用工作量证明(POW)算法的加密货币网络。矿工不断执行哈希函数,成为第一个创建可添加到区块链的新交易块的人。比特币矿机通常由数十个组件和数百个芯片组成。这些都是为了以尽可能高的能源效率进行加密货币挖掘。

Bitcoin machines are custom-made computers for encrypting money. Bitcoin miners are used to help handle transactions and protect encrypted monetary networks using the workload certificate (POW) algorithms. Miners are constantly implementing the Hashi function, becoming the first to create a new trade block that can be added to the block chain. Bitcoins are usually composed of dozens of components and hundreds of chips.

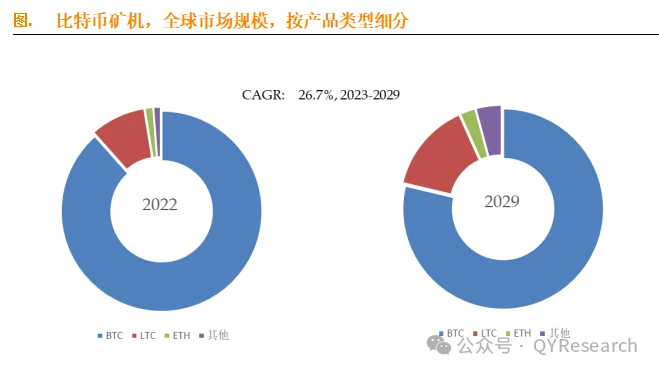

比特币矿机全球市场总体规模

据QYResearch调研团队最新报告“全球比特币矿机市场报告2023-2029”显示,预计2029年全球比特币矿机市场规模将达到238.4亿美元,未来几年年复合增长率CAGR为26.7%。

According to the latest report of the QYResearch team, “Global Bitcoin Market Report 2023-2029”, the global market for bitcoins is expected to reach $23.840 billion in 2029, with a combined growth rate of 26.7 per cent in CAGR over the next few years.

全球范围内比特币矿机生产商主要包括BitMain、MicroBT、Canaan、AGMH、iPollo等。2022年,全球前四大厂商占有大约98.0%的市场份额。

BitMain, MicroBT, Canaan, AGMH, iPollo, among others, are among the world-wide producers of BitMain, MicroBT and others. In 2022, the world’s top four manufacturers accounted for about 98.0 per cent of the market share.

主要驱动因素:

比特币价格:比特币的价格是采矿硬件市场的重要驱动力。?当比特币价格上涨时,开采比特币的利润就会更高,从而导致对采矿硬件的需求增加。比特币挖矿难度:随着比特币挖矿难度的增加,矿工需要更强大的硬件来维持盈利能力,导致对高性能挖矿硬件的需求增加。技术进步:制造商不断改进产品以实现更高的效率和性能,这吸引了寻求利润最大化的买家。

Bitcoin price: Bitcoin’s price is an important driver of the mining hardware market. When bitcoin prices rise, the profits from bitcoin are higher, resulting in increased demand for mining hardware. Bitcoin is difficult to dig: as bitcoin becomes more difficult to dig, miners need stronger hardware to sustain profitability, leading to increased demand for high-performance mining hardware.

主要阻碍因素:

竞争加剧:随着时间的推移,比特币矿机市场的竞争变得越来越激烈,新的制造商进入市场,老牌公司发布更新、更高效的型号。?这可能会使小公司难以竞争,并可能导致行业整合。比特币价格的波动:比特币的价格可能会波动,这会影响挖矿的盈利能力。?当比特币价格下跌时,采矿业的利润就会减少,这会导致对矿工的需求减少。中心化:随着矿工成本的增加,个体矿工很难与大规模挖矿业务竞争。?这将致比特币挖矿网络的中心化,并可能引发对网络安全和去中心化的担忧。

Competition has increased: competition in the Bitcoin market has become more intense over time, new manufacturers have entered the market, and old companies have issued updated and more efficient models. This may make it difficult for small companies to compete, and may lead to industrial consolidation. Bitcoin price volatility: Bitcoin prices may fluctuate, which may affect the profitability of mining.

行业发展趋势:

增加计算能力:随着比特币挖矿难度的增加,矿工需要具有更高计算能力的硬件来跟上。这导致了比特币挖矿硬件哈希率不断提高的趋势。提高能源效率:近年来,比特币挖矿的高能耗已成为人们关注的问题,导致了更加节能的硬件的发展趋势。制造商正在使用先进的制造工艺并优化其设计以实现更高的效率。挖矿权的集中化:比特币挖矿硬件的高成本使得个体矿工很难与大型挖矿业务竞争。?这导致了中心化的趋势,少数大型矿池控制了比特币网络哈希率的很大一部分。新技术的集成:一些制造商正在将新技术集成到他们的比特币挖矿硬件中,例如液体冷却和人工智能算法。这些技术有助于提高效率和性能,并且在未来可能会变得更加普遍。

Energy efficiency: In recent years, high energy consumption in bitcoin mining has become a concern, leading to the development of more energy-efficient hardware. Manufacturers are using advanced manufacturing processes and optimizing their design to achieve greater efficiency.

相关报告推荐“2024年全球比特币矿机行业总体规模、主要企业国内外市场占有率及排名”QYResearch将持续关注行业动态,为投资者和业内人士提供最新、最全面的市场分析和趋势预测。

The

本文侧重研究全球比特币矿机总体规模及主要厂商占有率和排名,主要统计指标包括比特币矿机产能、销量、销售收入、价格、市场份额及排名等,企业数据主要侧重近三年行业内主要厂商的市场销售情况。地区层面,主要分析过去五年和未来五年行业内主要生产地区和主要消费地区的规模及趋势。

This paper focuses on the overall size of the world's bitcoin mine and on the occupancy and ranking of major producers. The main statistical indicators include Bitcoin production, sales, sales earnings, prices, market share and ranking, and the focus of business data on market sales by major producers in the last three years of the industry. At the regional level, it mainly analyses the size and trends of major production areas and major consumption areas in the past five years and the next five years.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论