·SEC称,孙宇晨试图通过虚拟交易(洗售)计划人为增加TRX交易量,让员工在其控制的两个加密资产交易平台账户之间进行了超过60万次TRX虚拟交易。非法交易所用资产(TRX)全部系孙宇晨本人提供。

SEC claims that Sun Woo-mun tried to increase the volume of TRX transactions artificially through virtual trading (cleaning) schemes, allowing employees to make more than 600,000 TRX virtual transactions between the accounts of the two encrypted asset trading platforms under their control. All of the assets of the illegal exchange (TRX) were supplied by Sun Woo-mun himself.

·一份声明说,孙宇晨据称策划了一场名人促销活动,诱使投资者购买TRX和BTT代币,并隐瞒了名人通过推文获得报酬的事实。

波场(Tron)创始人、火币(Huobi)全球顾问委员会成员孙宇晨(Justin Sun)。

Justin Sun, founder of Tron and member of the Huobi Global Advisory Committee.

SEC称,孙宇晨试图通过虚拟交易(洗售)计划人为增加TRX交易量,让员工在其控制的两个加密资产交易平台账户之间进行了超过60万次TRX虚拟交易。每日通过这些洗售交易大约450万至740万个TRX,非法交易所用资产(TRX)全部系孙宇晨本人提供。

According to SEC, Sun Woo’s attempt to increase the volume of TRX transactions artificially through virtual trading (shuffling) schemes has allowed employees to make more than 600,000 TRX virtual transactions between the two encrypted asset trading platforms that they control. Some 4.5 to 7.4 million TRX transactions are carried out daily through these shufflings, and all of the assets of the illegal exchange (TRX) are supplied by Sun Woo’s own.

美国证券交易委员会主席加里·金斯勒(Gary Gensler)表示:“这个案例再次表明,在没有适当披露的情况下提供和出售加密资产证券时,投资者将面临高风险。”

The Chairman of the United States Securities and Exchange Commission, Gary Gensler, stated: “This case again shows that investors face a high risk when encrypted asset securities are offered and sold without proper disclosure”.

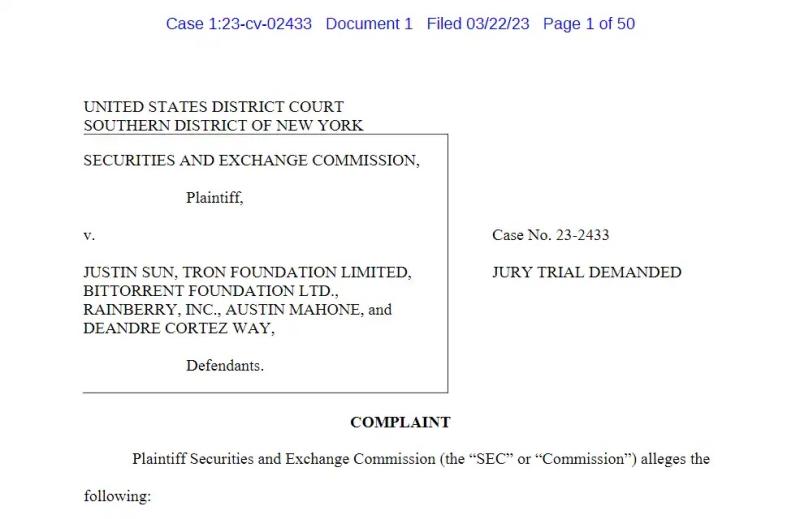

SEC起诉孙宇晨的文件。

SEC sued Sun Woo morning's papers.

金斯勒在一份声明中说,孙宇晨据称通过“策划一场促销活动,他和他的名人发起人隐瞒了名人通过推文获得报酬的事实”,从而诱使投资者购买TRX和BTT代币。

In a statement, Kingsler stated that Sun Woo morning allegedly induced investors to purchase TRX and BTT tokens by “organizing a marketing campaign in which he and his celebrity sponsors concealed the fact that celebrities were paid through tweets”.

8位名人或网红是:女演员林赛·罗翰(Lindsay Lohan)、社交媒体名人杰克·保罗(Jake Paul)、音乐人士德安德烈·科尔特兹·维(DeAndre Cortez Way,也被称为Soulja Boy)、音乐人士奥斯汀·马宏(Austin Mahone)、女演员米歇尔·梅森(Michele Mason,被称为Kendra Lust)、音乐人士沙弗尔·史密斯(Shaffer Smith,被称为 Ne-Yo)、音乐人士阿里奥内·蒂亚姆(Aliaune Thiam,又名Akon)。除了Soulja Boy和马宏外,所有人都同意共同支付40万美元的非法所得、利息和罚款以了结指控。和解不意味着承认或否认有罪。

Eight celebrities or Reds are: actress Lindsay Lohan, social media celebrity Jake Paul, musician DeAndre Cortez Way, also known as Soulja Boy, musician Austin Mahone, actress Michelle Mason, known as Kendra Lust, musician Shaffer Smith, known as Ne-Yo, musician Alioune Thiam, also known as Akon. All but Soulja Boy and Mahon agree to pay a sum of US$ 400,000 in illegal proceeds, interest and fines to settle the charges.

女演员林赛·罗翰(Lindsay Lohan)。

actress Lindsay Lohan.

这些名人支持者在社交媒体上推广TRX和BTT代币,并招募其他人加入Tron相关的社交媒体频道。美国证券交易委员会执法负责人古尔比尔·格鲁瓦尔(Gurbir Grewal)在一份声明中表示,Tron及其支持者的行为是“误导和伤害投资者的古老剧本”的一部分。“孙向在社交媒体上拥有数百万粉丝的名人支付费用,以宣传未注册的产品,同时特别指示他们不要透露报酬。这正是联邦证券法旨在防止的行为,无论孙和其他人使用的标签如何。”格鲁瓦尔说。

These celebrity supporters promote TRX and BTT in social media and recruit others into Tron-related social media channels. The US Securities and Exchange Commission’s executive head, Gulbir Grewal, stated in a statement that the actions of Tron and his supporters were part of an “old script that misleads and harms investors.”

孙宇晨在波场的代表没有立即回复媒体的置评请求。

Sun Woo's representative at the stadium did not respond immediately to the media's request for comments.

TRX因SEC的指控而下跌13%。与孙宇晨相关的其他代币,包括火币(HT)、Just(JST)和Sun Token(SUN)22日也下跌超过5%。

TRX fell by 13% because of the SEC’s charges. Other coins associated with Sun Woo’s morning, including HT, Just (JST) and Sun Token (SUN), also fell by more than 5% on 22nd.

SEC加大对加密货币的执法力度

SEC has increased enforcement of encrypted money.

同一天,SEC还对加密货币交易所Coinbase发布了“韦尔斯通知”。韦尔斯通知是由监管机构发出的通知,告知个人或公司,已经完成的调查发现了违规行为,通常是SEC正式发布指控前的最后步骤之一,一般会列出监管论点的框架,并为可能被指控的人提供反驳指控的机会。

On the same day, the SEC also issued the “Wells Notice” to Coinbase of the Encrypted Currency Exchange. The Wells Notice was issued by the regulatory authority, informing individuals or companies that completed investigations had revealed irregularities, usually one of the last steps before the official release of the SEC charges, generally setting out a framework for regulatory arguments and providing potential accused persons with an opportunity to rebut the charges.

SEC最近一段时间加大了对加密货币行业的执法力度,打击“兜售未注册证券”的公司和项目。2022年年中,SEC对Coinbase进行调查的报道首次浮出水面。Coinbase的高管,包括创始人兼首席执行官布赖恩·阿姆斯特朗(Brian Armstrong)已经反对SEC“过度干预”。

In mid-2022, reports of the SEC investigation into Coinbase showed up for the first time. Coinbase’s executives, including his founder and CEO, Brian Armstrong, have opposed the SEC’s “excessive intervention”.

Coinbase首席法务官保罗·格鲁瓦尔(Paul Grewal)在博客文章中表示:“尽管我们不会对这一事态掉以轻心,但我们对我们经营业务的方式非常有信心——与我们向美国证券交易委员会提交的业务相同,以便我们能在2021年成为一家上市公司。”

In his blog post, Paul Grewal, Chief Legal Officer of Coinbase, said: “Although we will not take this matter lightly, we have great confidence in the way we run our business — the same business we submitted to the United States Securities and Exchange Commission — so that we can become a listed company in 2021.”

该公司表示,在解决任何法律程序之前,其交易所的产品将继续照常运作。“根据与员工的讨论,公司认为这些潜在的执法行动将与公司现货市场、质押服务Coinbase Earn、Coinbase Prime和Coinbase Wallet的各个方面有关。”Coinbase 在一份监管文件中表示。

The company stated that the products of its exchange would continue to function as usual until any legal proceedings were resolved. “In the light of discussions with its employees, the company believes that these potential enforcement actions will relate to various aspects of the company's spot market, its pledge service Coinbase Earn, Coinbase Prime and Coinbase Wallet.” Coinbase indicated in a regulatory document.

在2022年11月加密货币交易所FTX 崩盘前几个月,加密货币市场因利率上升和广泛的风险转移而动荡,导致稳定币Terra崩盘和加密对冲基金“三箭资本”以及交易所Celsius和Voyager破产。自FTX崩溃以来,SEC一直在积极打击加密行业。在金斯勒的布局下,该监管机构已对多个重量级人物采取执法行动,包括加密货币交易所Gemini、Genesis、孙宇晨、韩国加密货币大亨Do Kwon和交易所Kraken。

In November 2022, months before the collapse of the encrypted currency exchange FTX, the market for encrypted currency was destabilized by rising interest rates and widespread risk shifts, leading to the stabilization of the “three arrow capital” of the currency Terra crash and the encryption hedge fund, as well as the bankruptcy of the exchange Celsius and Voyager. Since the collapse of the FTX, the SEC has been actively fighting the encryption industry. Under the layout of Kingsler, the regulator has taken enforcement action against a number of heavyweight individuals, including the encrypted currency exchange Gemini, Genesis, Sun Woo-jung, the encrypted currency tycoon Do Kwon and the exchange Kraken.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论