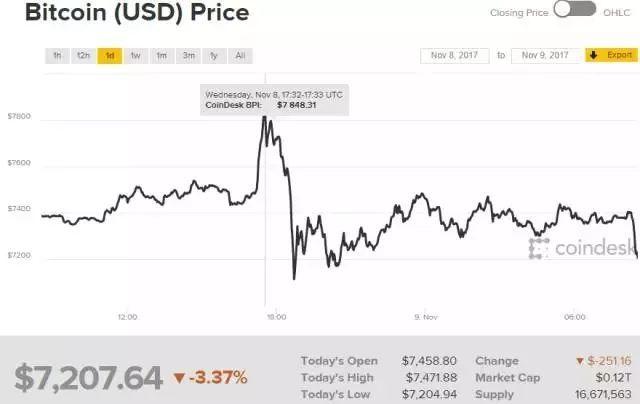

比特币,作为全球最知名的加密货币,其价格波动一直是投资者和市场分析师关注的焦点。近期,比特币价格再次出现显著波动,回落至每枚比特币价值低于美元的水平,日内跌幅达到了惊人的百分比。这一现象不仅影响了加密货币市场,也对全球金融市场产生了一定的影响。本文将深入分析比特币价格回落的原因、影响以及未来可能的走势。

Bitcoin, the world’s most well-known encrypted currency, price volatility has been the focus of attention by investors and market analysts. In the recent past, Bitcoin prices have again fluctuated significantly, falling to levels below the dollar and falling by an alarming percentage per day.

1. :加密货币市场情绪极易受到各种消息的影响。例如,监管政策的变化、大型投资者的买卖行为、甚至是社交媒体上的言论都可能引起市场情绪的波动。

1. Encrypted currency market sentiment is highly susceptible to information. For example, changes in regulatory policies, the buying and selling behaviour of large investors, and even social media discourse can cause market mood fluctuations.

2. :比特币网络的技术问题,如交易速度慢、手续费高,也可能导致投资者信心下降,从而影响价格。

2. The technical problems of the Bitcoin network, such as the slow pace of transactions and high transaction costs, may also lead to a decline in investor confidence, thus affecting prices.

3. :全球经济环境的变化,如利率调整、经济衰退的担忧等,也会对比特币等风险资产产生影响。

3. Changes in the global economic environment, such as interest rate adjustments and concerns about economic downturns, have also had an impact on venture assets such as the bicentenary.

4. :各国政府对加密货币的监管态度和政策调整,尤其是中国等主要经济体对加密货币交易的限制,对市场价格有直接影响。

4. Governments'regulatory attitudes and policy adjustments to encrypted currencies, in particular the restrictions imposed by major economies, such as China, on encrypted currency transactions, have a direct impact on market prices.

1. :价格的大幅下跌可能会导致投资者信心受损,尤其是那些在高点买入的投资者,可能会面临较大的损失。

1. Large price declines may result in erosion of investors'confidence, especially those buying at high points, which may face significant losses.

2. :价格波动可能会影响市场的流动性,增加交易成本和风险。

2. Price fluctuations may affect market liquidity and increase transaction costs and risks.

3. :长期的低价可能会影响新投资者的进入,限制市场的发展潜力。

3. Long-term low prices may affect the entry of new investors and limit the development potential of markets.

4. :比特币价格的下跌也会影响到与其相关的产业链,如矿机制造商、交易平台等。

4. : The fall in the price of bitcoin will also affect the chain of industries associated with it, such as mine manufacturers, trading platforms, etc.

1. :通过历史数据和图表分析,技术分析师可能会预测比特币价格的未来趋势。

1. _: Through historical data and graphic analysis, technical analysts may predict future trends in Bitcoin prices.

2. :考虑到比特币的基本面因素,如采用率、技术创新、市场需求等,可以对未来价格进行预测。

2. : Future prices can be projected taking into account basic Bitcoin factors, such as adoption rates, technological innovation, market demand, etc.

3. :市场情绪的变化也是预测价格走势的重要因素,需要密切关注市场动态和投资者情绪。

3. Changes in market sentiment are also important factors in predicting price trends and require close attention to market dynamics and investor sentiment.

4. :全球经济环境的变化将继续影响比特币等加密货币的价格。

4. Changes in the global economic environment will continue to affect the price of encrypted currencies such as Bitcoin.

比特币价格的回落至美元下方,日内跌幅显著,这一现象是多方面因素共同作用的结果。投资者在面对此类市场波动时,应保持谨慎,合理评估风险,并根据自身的投资策略做出决策。未来,比特币及整个加密货币市场的走势将受到技术、基本面、市场情绪和宏观经济等多重因素的影响。对于市场参与者而言,理解这些因素并做出相应的策略调整至关重要。

In the face of such market fluctuations, investors should be careful to assess risks properly and make decisions based on their own investment strategies. In the future, the movement of Bitcoins and the entire encrypted currency market will be influenced by multiple factors, such as technology, fundamentals, market sentiment, and macroeconomics.

加密货币市场虽然充满不确定性,但其创新性和潜在的高回报依然吸引着全球投资者的目光。比特币作为市场的领头羊,其价格波动无疑将继续成为市场关注的焦点。投资者和市场分析师需要持续关注市场动态,以便更好地把握投资机会和风险。

As the leading head of the market, Bitcoin will undoubtedly continue to be the focus of market attention. Investors and market analysts need to keep an eye on market dynamics in order to better capture investment opportunities and risks.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论