以太坊在过去七天中,以太坊曾多次突破 3,900 美元,但未能维持这一水平。市场似乎预计美国证券交易委员会 (SEC) 批准以太坊现货交易所交易基金 (ETF) 将带来提振,因为以太坊的涨势发生在 5 月 21 日,也就是该决定的两天前。

有人可能会说,现货 ETF 交易员仍在等待每只基金的 S-1 表格批准。彭博高级 ETF 分析师 Eric Balchunas 预计以太坊现货工具将于 7 月 4 日开始交易,而他的同事 James Seyffart 指出,贝莱德于 5 月 29 日更新的 S-1 显示发行人和 SEC 正在努力推出现货以太坊 ETF。

One might say that the spot ETF trader is still waiting for approval of each fund's S-1 form. Eric Balchunas, a senior ETF analyst in Bloomberg, is expected to start trading with the Taipan off-the-shelf tool in July 4, while his colleague James Seyffart notes that the S-1 updated by Beled on May 29 shows that the issuer and SEC are working to push the ETF into the future.

然而,分析师暗示,如果 Grayscale Ethereum Trust (ETHE) 在转换为 ETF 后的几周内出现资金流出,ETH 可能会面临压力。由于费用高昂,类似的问题也困扰着Grayscale 的比特币基金 (GBTC)。一些人猜测,仅 Grayscale ETHE 的资金流出量在最初几周就可能超过每天 1 亿美元,从而抵消甚至超过新投资者的资金流入。

However, the analyst suggests that the ETH could be under pressure if there were a financial outflow within weeks of the conversion to ETF. Similar problems also plagued the Grayscale 'expernal 'href 'href'" https://www.qkl456.html "target="blank" ETHE. Due to the high cost, similar problems also plagued the Grayscale 'expernal' href="https://www.qkl456.com/site/609.html"title="bitcoin" target="_blank' >bitcoin funds ("exernal" href" https://www.kl456.com/site"

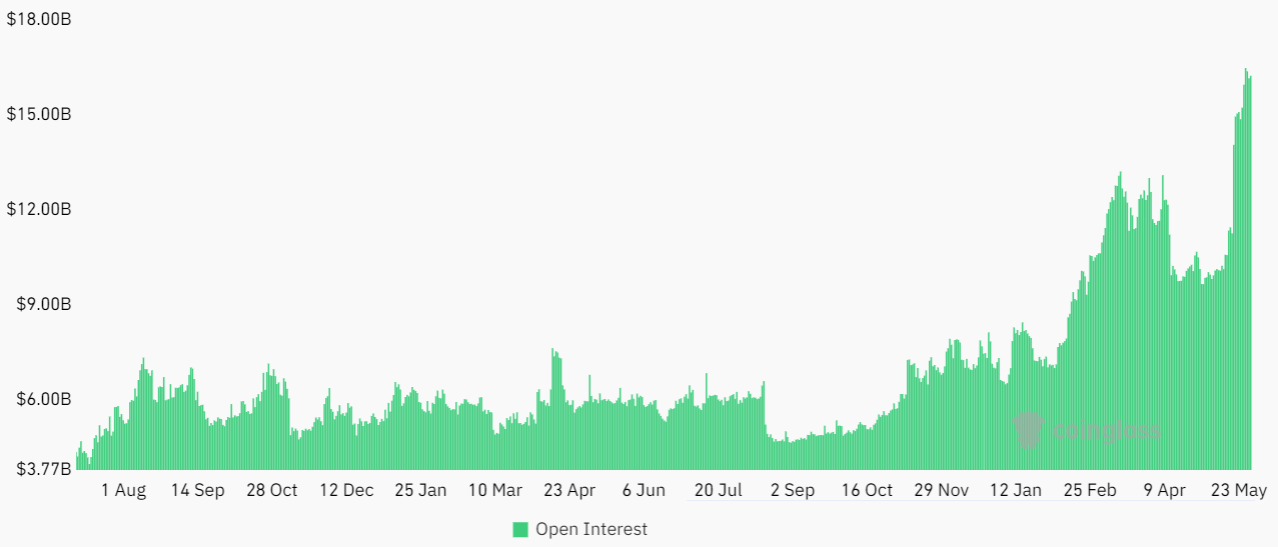

从本质上讲,以太币未能突破 3,900 美元阻力位的部分原因是现货 ETF 获批之前的反弹。一些投资者对有效交易需要更长时间感到失望,这一事实也造成了一些不确定性和负面价格影响。这可能会带来麻烦,因为以太币的期货未平仓合约在 5 月 28 日升至历史最高水平。

The fact that some investors are disappointed that effective transactions will take longer is also causing some uncertainty and negative price implications. This could cause trouble, as the futures of the currency’s unsettled contracts rose to record highs on May 28th.

未平仓合约衡量了每个衍生品交易所(包括币安、CME、OKX 和 Bybit)可用的 ETH 期货合约总数。

The unscathed contracts measure the total number of ETH futures contracts available for each derivative exchange (including currency security, CME, OKX and Bybit).

尽管 ETH 期货多头(买家)和空头(卖家)始终处于匹配状态,但名义金额越高,清算风险就越大。例如,如果多头使用 10 倍杠杆,则平均而言,如果 ETH 的价格下跌 10%,这些合约将被强制清算。

Although ETH futures are always in a position of matching (buyers) with empty (sellers), the higher the nominal amount, the greater the risk of liquidation. For example, if more than 10 times the leverage is used, on average, if ETH prices fall by 10%, these contracts will be forced to settle.

如果以太币的价格突然上涨 10%,而空头使用过多杠杆,也会出现类似的相反走势。在这种情况下,交易所会自动购买 ETH 期货以消除风险,并平仓缺乏相应保证金存款的头寸。因此,以太币期货 168 亿美元的未平仓合约对潜在买家构成风险,使 ETH 价格保持在 3,900 美元以下。

In this case, the exchange automatically buys ETH futures to eliminate risk and unwinds the position of deposit deposits. Thus, an unsavory contract of US$ 16.8 billion with the EDP poses a risk to potential buyers, keeping the ETH price below US$ 3,900.

以太坊的高昂 gas 费用可能被视为成功的标志,表明对区块空间的需求持续存在。然而,它们也为专注于高可扩展性的竞争区块链提供了机会。部分活动已迁移到以太坊第 2 层解决方案,但一些用户和项目选择了 BNB Chain、Solana 或 Aptos。

High gas costs may be seen as a success sign, indicating a continuing demand for block space. However, they also provide an opportunity to focus on high-extensible competition . Some activities have been relocated to the 2nd floor solution in Etai, but some users and projects have chosen 认为每个去中心化应用程序 (DApp) 都需要以太坊提供的去中心化水平的想法是天真的。从事简单金融、赌博或游戏的用户通常不愿意使用桥接解决方案来访问费用较低的环境。因此,以太坊主网容量增长落后于竞争对手通常被视为错失的机会。 It is naive to think that every decentralized application (DApp) requires a decentralised level of effort provided by the Taiwan. Users of simple finance, gambling or games are often reluctant to use bridge solutions to access lower-cost environments. Thus, it is often seen as a missed opportunity that the growth in the capacity of the Taiwan home network lags behind competitors. 5 月 30 日,以太坊的 DApp 活跃地址数(UAW)为 122,350,较前一天下降了 2%。同样,以太坊网络的总交易量在同一时期仅增长了 2%。这些数据表明,尽管以太坊拥有强劲的基本面、多种 DApp 用例和多样化的投资者配置,但人们倾向于采用替代区块链。 On May 30, the number of DApp active addresses (UAWs) was 122,350, a decrease of 2% from the previous day. Similarly, the total volume of transactions on the network grew by only 2% over the same period. 例如,BNB Chain 的每日活跃地址数为 508,610 个,是以太坊的四倍多。这些用户在过去七天内在 PancakeSwap 上交易了超过 35 亿美元,而单个 DApp Move Stake 在同一时期聚集了超过 226,350 个活跃地址。简而言之,以太坊的链上指标并不能激发信心,进一步限制了以太币在短期内突破 3,900 美元的潜力。 For example, BNB Chain has 508,610 active daily addresses, more than four times as many as in the Taiku. These users have traded more than $3.5 billion on PancakeSwap over the past seven days, while individual Dapp Move Stake has gathered more than 226,350 active addresses over the same period. In short, the Etherbank chain indicators do not inspire confidence, further limiting the potential for a short-term breakthrough of $3,900.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论