1、DeFi的概念

1, the DeFi concept

DeFi是Decentralized Finance(去中心化金融)的缩写,也被称做Open Finance。它实际是指用来构建开放式金融系统的去中心化协议,旨在让世界上任何一个人都可以随时随地进行金融活动。

DeFi is an acronym for Decentralized Finance, also known as Open Finance. It is a decentralized agreement designed to create an open financial system that allows any person in the world to carry out financial activities at any time or place.

2、DeFi特点

& nbsp;2, DeFi characteristic

DeFi 有几个突出的特点:

DeFi has several salient features:

- 基于区块链技术

- 资产由个人掌控

- 清结算都是实时通过智能合约完成的

- 通过对信任的最小化依赖,降低个体与个体间的信任成本

3、DeFi同传统金融的区别

3 , the difference between DeFi and traditional finance

金融服务主要由中央系统控制和调节,无论是最基本的存取转账、还是贷款或衍生品交易。DeFi则希望通过分布式开源协议建立一套具有透明度、可访问性和包容性的点对点金融系统,将信任风险最小化,让参与者更轻松便捷地获得融资。

Financial services are largely controlled and regulated by a central system, whether it is the most basic access transfer, loan or derivative transaction. DeFi, for its part, hopes to create a transparent, accessible and inclusive point-to-point financial system through distributed open-source agreements that minimizes the risk of trust and makes financing easier and easier for participants.

相比传统的中心化金融系统,这些DeFi平台具有三大优势:

These DeFi platforms have three main advantages compared to the traditional centralized financial system:

a. 有资产管理需求的个人无需信任任何中介机构新的信任在机器和代码上重建;

a. Individuals with asset management needs do not need to trust any new intermediary trust in rebuilding machinery and codes;

b. 任何人都有访问权限,没人有中央控制权;

b. Anyone has access and no one has central control;

c. 所有协议都是开源的,因此任何人都可以在协议上合作构建新的金融产品,并在网络效应下加速金融创新。

c. All agreements are open-source, so anyone can cooperate on agreements to build new financial products and accelerate financial innovation with network effects.

DeFi是个较为宽泛的概念,包括:货币发行、货币交易、借贷、资产交易、投融资等。

DeFi is a broader concept, including currency issuance, currency transactions, borrowing, asset transactions, investment financing, etc.

我们将BTC和其他加密货币的诞生视为DeFi的第一阶段。然而将货币的发行和存储分散化只是提供了点对点结算的解决方案,还不足以支撑丰富的金融业务。而近两年发展迅猛的去中心化借贷协议将有机会进一步开放区块链世界的金融系统,将DeFi带入第二阶段。

We see the birth of BTC and other encrypted currencies as the first phase of the DeFi. However, decentralization of currency distribution and storage is simply a solution that provides a point-to-point settlement, and is not sufficient to sustain rich financial operations.

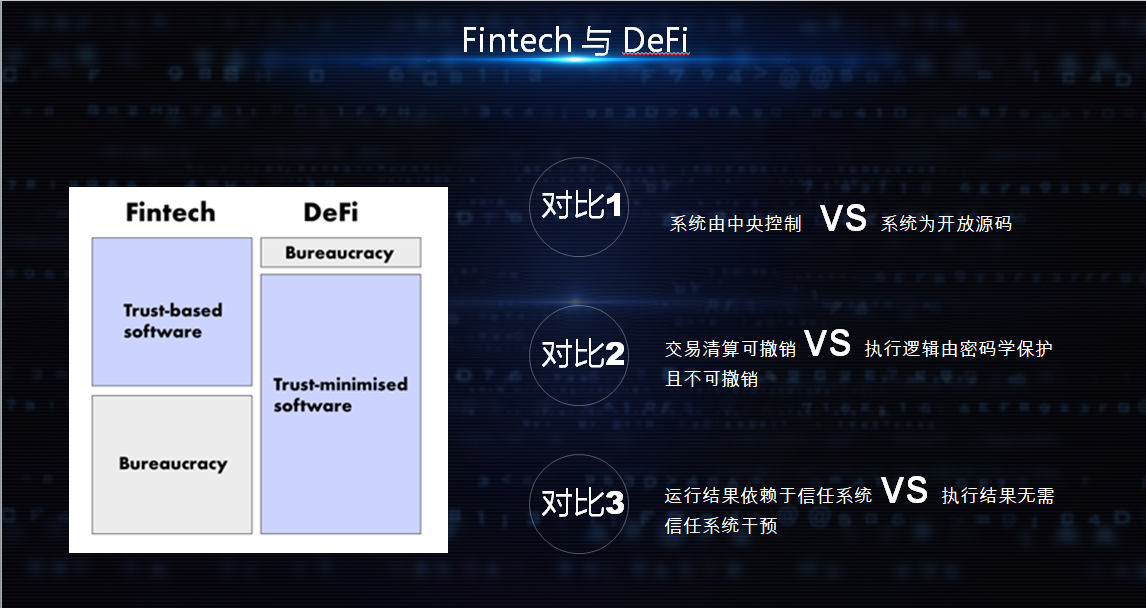

FinTech 根植于一套官僚和信任机制, DeFi 将对信任机制的依赖大幅降低。

FinTech is rooted in a set of bureaucratic and trust mechanisms, and DeFi will significantly reduce its reliance on trust mechanisms.

FinTech 所用的软件系统都是某个公司私有的,其运行的环境是个人为控制的完全授信的环境。所有相关的交易和清结算都是不受不可撤销性保护的,运行结果的最终裁决依赖于背后的一个信任系统,而非代码本身。

FinTech uses software systems that are privately owned by a company and operate in a fully trusted environment controlled by individuals. All related transactions and settlements are not protected by irrevocableness.

DeFi 所用的软件系统都是开放源代码的。不管是比特币还是闪电网络,抑或是通过以太坊智能合约,核心逻辑的执行都是由密码学保护且不可撤销的,执行过程在一个去信任的区块链网络上,执行结果也无需信任系统的干预。

The software systems that DeFi uses are open-sourced. Whether it's a bitcoin or a lightning network, or through an Etherno smart contract, the implementation of the core logic of

如何理解 Trust-based 和 Trust-minimised?

How do you understand Trust-based and Trust-minimized?

对于 Trusted-based 的东西,你要通过它做事情的话,必须信任它以及它背后的组织,没有选择,它对于你来说是个黑箱。而对于 Trust-minimised 的东西,你可以完全不相信它背后的组织,也可以不相信它,可以通过任何方式去验证审核,它对于你来说完全开放。

For trusted-based things, if you want to do things through it, you have to trust it and the organization behind it, with no choice, and it's black box for you. And for trust-minimised things, you can totally trust the organization behind it, or you can not believe it, and it can be verified in any way, and it's completely open to you.

4、DeFi 的诞生

4, the birth of DeFi

一个DeFi产品,其本质是一个或一组智能合约。

A DeFi product, the essence of which is a smart contract or set of contracts.

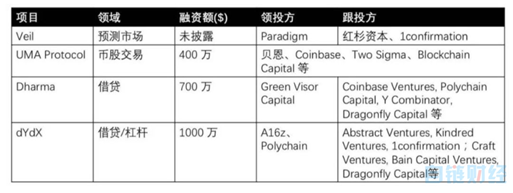

在18年的熊市,华尔街和硅谷精英们发现,其实智能合约天然适合金融领域。几个代表性的DeFi项目在18年冬-19年春的资本寒冬市场,逆势融资,智能合约这颗种子真正找到了自己的土壤。

In 18 years of Bear City, Wall Street and Silicon Valley elites have found that smart contracts are naturally appropriate in the financial field. Several representative DeFi projects have found their own soil in the winter 18-19 spring capital winter market, in reverse financing, and in the seed of smart contracts.

除了去中心化交易所,借贷、保证金交易、预测市场、差价合约等等金融产品,都开始用智能合约去构建。

In addition to going to a central exchange, lending,

由于 DeFi 在以太坊的兴起,以太坊也似乎找到了新的自我定位:从世界计算机,到全球经济结算层。

As a result of the rise of DeFi in Etheria, Ether seems to have found a new self-identification: from the world computer to the global economic settlement.

世界计算机是什么?是区块链+图灵完备。

What's a world computer? It's a block chain plus Turing's perfect.

全球链上经济结算层是什么?是一个无需准入的、无需信任的、可抗监管的、资产在链上全球性自由流动的金融体系。

What is the economic settlement layer in the global chain? A non-accessible, untrustworthy, non-restrictive financial system with a global free flow of assets in the chain.

去中心化金融最早期的一批项目都是基于以太坊上的项目。

The earliest projects to go to central finance are based on the Etheria project.

这些项目中流动的ETH越多,ETH就变得越来越稀缺。ETH日益稀缺又推高了交易商和投资者的需求,从而提高了ETH价值。因此,对于持有ETH的人来说,DeFi的发展是一个好消息。

The more ETHs flow in these projects, the more scarce ETHs become. The more scarce ETHs push the demand of traders and investors, thus increasing the ETH value. Therefore, the development of DeFi is good news for those who hold ETHs.

既然DeFi的本质是智能合约,智能合约之间又具有「互操作性」(interoperable)。那么,DeFi产品之间就可以交互,像搭积木一样,拼接出多样、多级的形态。

Since the essence of DeFi is a smart contract, there is an "interoperable" between smart contracts.

5、DeFi 项目有哪些?

What are the & nbsp; 5, DeFi projects?

目前的DeFi项目主要建立在以太坊公链,以太坊本身的市值已经在180亿美金左右,仅仅在以太坊生态,DeFi都将是一个不小于百亿美金的市场。

The current DeFi project is based mainly on the Etherkom community chain, where the market value is already around $18 billion, and in the Etheraya ecology alone, DeFi will be a market of not less than $10 billion.

目前基于区块链技术的DEFI的市场参与者和项目,包括了基础设施、支付、KYC和数字身份、稳定币、保险、去中心化交易所和流动性支持、金融衍生品、信贷、投融资、信托等多个方面。

DFI market participants and projects currently based on block chain technology include infrastructure, payments, KYC and digital identity, currency stability, insurance, decentralized exchange and liquidity support, financial derivatives, credit, investment finance, trusts, etc.

- MakerDAO 允许人们通过在智能合约上抵押自己的数字资产来发行稳定币 DAI。

- dy/dx 一个基于以太坊的去中心化保证金和衍生品交易协议。

- Compound 定位于货币市场的去中心化协议。可以看作是数字货币世界的货币基本或余额宝。

- CDx 去中心化的信用违约互换协议。人们可以用它来对冲交易风险。

- Loopring 去中心化交易所协议。

- Connex 一个支持低费用,低延迟交易的以太坊状态通道网络

(1)支付

(1) pays

闪电网络

Lightning Network

https://www.block123.com/zh-hans/nav/117091519057.htm

闪电网络是在比特币区块链网络上运行的一个二层支付协议 ,在 10 个月时间内,从 60 个节点迅猛增长至 3,000 个节点以上,拥有 1.1 万个开放通道,网络总交易量达到 70 万美元以上。

The Lightning Network is a second-tier payment agreement operating on the Bitcoin block chain network, which has grown rapidly from 60 nodes to more than 3,000 nodes over a 10-month period, with 1.1 million open channels with a total network turnover of over $700,000.

雷电网络 Raiden Network

Thunderline Raiden Network

https://www.block123.com/zh-hans/nav/637770605257.htm

雷电网络是状态通道技术在以太坊上提高交易处理能力的一个应用,利用链下 off-chain 状态网络对以太坊交易处理能力进行扩展,利用雷电网络转账以太坊资产。雷电节点与以太坊节点一起运行,可以和其它雷电节点通信,实现转账,也可以和以太坊区块链通信,管理保证金存款。雷电网络的第一个主网版本Red Eyes刚刚上线。

Thundernet is an application of state-of-the-art technology to improve transaction processing capabilities at the Etherm, extending Ether trading processing capabilities using the off-chain state network under the chain, and using thunder network transfers as Taiyan assets. Thundernodes run with Ether nodes, can communicate with other thundernodes, effect transfers, and can communicate with the Ether block chain to manage deposit deposits. The first main version of the network is Red Eyes has just been online.

(2)去中心化交易

& nbsp; (2) to centralize transactions

0x

https://www.block123.com/zh-hans/nav/637770605257.htm

以太坊上的去中心化交易协议。使用 0x 去中心化交换协议的应用俗称「Relayer」,可以在以太坊区块链上打造 ERC20 代币交易所,并透过它收取费用。0x 的 2.0 版本已经上线。

A decentralised deal agreement in the Taiwan. The application of the 0x to centralize the exchange protocol is commonly called "Relayer ", which allows the ERC20 token exchange to be created on the Etheria block chain and charged through it. Version 2.0 of the 0x is already online.

全球最大的以太坊数字钱包 imToken 在今年早些时候宣布,旗下的去中心化交易平台 Tokenlon 将与 0x 达成战略合作,利用 0x 智能合约技术,实现无缝的原子币币兑换功能,并正式登陆 imToken 2.0 国际版。

Tokenlon, the world's largest e-Thai digital wallet, announced earlier this year that a decentralised trading platform under the flag would work strategically with 0x to achieve seamless Atomic Currency exchange with 0x smart contract technology and officially log into ImToken 2.0 International.

0x 属于开源协议,所以它可以进行分叉。

0x is open source, so it can make forks.

Hydro

https://www.block123.com/zh-hans/nav/634132288396.htm

去中心化交易所 DDEX 团队分叉 0x 重写的一个去中心化交易协议。DDEX 团队最近宣布将「分叉」0x 协议,在 0x 协议基础上重写其代码库,发布新的去中心化交易协议 Hydro;等到新协议发布后,DDEX 将转移至 Hydro 协议,并不再使用 ZRX 代币,因为「ZRX 代币产生了不必要的摩擦」。目前 DDEX 是最大的基于 0x 协议的去中心交易所,其交易量占了所有 0x 协议上交易量的 40% 以上。

The DDEX team has recently announced that it will rewrite the "Fix" 0x protocol, rewrite its code library on the basis of the 0x protocol, issue a new decentralised deal, Hydro; when the new deal is released, the DDEX will be transferred to the Hydro protocol and will no longer use ZRX tokens because "ZRX tokens cause unnecessary friction." The DDEX team is currently the largest central exchange based on the 0x protocol, with transactions accounting for more than 40 per cent of all 0x agreements.

路印协议 Loopring

https://www.block123.com/zh-hans/nav/501056517957.htm

去中心化交易平台协议路印协议 Loopring 已在以太坊、NEO 和 Qtum 上运行,最近宣布在 Wanchain 正式上线,其 LRC 代币已经整合进 Wanchain 3.0。

Loopring running on Etheria, NEO and Qtum, recently announced official access to Wanchain, whose LRC tokens have been integrated into Wanchain 3.0.

Swap

https://www.block123.com/zh-hans/nav/987659184888.htm

针对以太坊 ERC20 代币点对点交易的协议。Swap 允许用户迅速地与已知的对手进行交易,而非提交订单到一个公共订单簿上。

A protocol for trading with the ERC20 dots. Swap allows users to deal quickly with known rivals, instead of submitting an order to a public order book.

(3)借贷协议

& nbsp; (3) Lending Agreement

Compound

https://www.block123.com/zh-hans/nav/429014874207.htm

以太坊上的代币借贷平台,用户可以在该平台存入数字资产,然后获取利息;也可以抵押数字资产来借贷其它的数字资产。

A money lending platform in the Taiwan, where users can deposit digital assets and then obtain interest; or encumber digital assets to borrow other digital assets.

Dharma

https://www.block123.com/zh-hans/nav/405588568872.htm

以太坊上的通用贷款协议。

A general loan agreement at the Tatiya.

(4)稳定币

& nbsp; (4) Stable Currency

Dai

https://www.block123.com/zh-hans/nav/673185887329.htm

以太坊上的智能合约系统 MakerDAO 发行的去中心化稳定币。Dai 由链上资产足额抵押担保发行,实现和美元保持比价稳定。目前 Dai 是规模最大的去中心化稳定币。除了可以作为交易所的基础货币避险资产之外,Dai 可以用作抵押贷款。个体用户、企业、金融机构都可以通过 Maker 开发的智能合约,无中心化风险地获得 Dai 作为流动性和对冲资产。

Dai is currently the largest decentralized stabilizing currency. In addition to the assets that can be used as a base currency for the exchange, Dai can be used as a mortgage. Individual users, businesses, and financial institutions can access Dai as a liquid and hedge asset without centralizing risk through the smart contracts that Maker has developed.

(5)预测市场及衍生品交易

(5) Forecasting markets and derivatives trading

Augur

https://www.block123.com/zh-hans/nav/674095897562.htm

一个在以太坊网络上建设的去中心化的、开源的、点对点的预测市场协议。近期Augur 上一个与美国中期选举有关的预测市场成交额达到 100 万美元以上。该市场的创建者使用的是一个假名地址。

A decentralised, open-source, point-to-point predictive market agreement built on the Etherms network. The last forecast market in Augur recently related to the mid-term elections in the United States is worth more than $1 million.

Gnosis

https://www.block123.com/zh-hans/nav/515623702799.htm

一个欧洲的团队开发的去中心化的预测市场应用。Gnosis 团队还开发了一个基于荷兰拍卖原则的 ERC20 代币去中心化交易协议「DutchX」,该协议不依靠订单模型,而是用拍卖模型,从而可以避免中间商利用信息优势抢先交易,实现完全去中心化。Gnosis 团队计划在明年 4 月推出去中心化自治组织 dxDAO 来实现 DutchX 的社区自治。

The Gnosis team has also developed an ERC20 decentralised transaction agreement, DutchX, based on Dutch auction principles, which relies not on an order model, but on an auction model, so that brokers can avoid using information advantages to pre-empt transactions and achieve complete decentralization. The Gnosis team plans to launch a decentralized self-government organization, dxDAO, in April next year to achieve DutchX community autonomy.

dYdX

https://www.block123.com/zh-hans/nav/747224275821.htm

基于以太坊的衍生品交易平台,提供可以用于做空以太坊代币 ETH 和其他 ERC20 标准代币的协议,从而让投资者可以利用协议对 ERC20 代币进行杠杆投资。

Based on Ether's derivative trading platform, agreements that can be used to make ETH and other ERC20 standard tokens available to investors can be leveraged to invest in ERC20.

该公司去年年底完成了种子轮融资,这轮总计 200 万美元的融资中,Andreessen Horowitz 和 Polychain 领投,Kindred Ventures 和 Abstract Ventures 跟投。Juliano 还得到包括 Coinbase 首席执行官 Brian Armstrong 和联合创始人 Fred Ehrsam 的天使投资,此外,著名的连续投资者 Elad Gil 也是该项目的天使投资人。

The company completed seed rotation financing at the end of last year, with a total of $2 million in financing rounds led by Andreasn Horowitz and Polychain, Kindred Ventures and Abstact Ventures. Juliano also received an angel investment, including Coinbase CEO Brian Armstrong and the co-founder, Fred Ehrsam, and a prominent successive investor, Elad Gil, was also an angel investor in the project.

(6)资产代币化

(6) monetization of assets

Abacus

https://www.block123.com/zh-hans/nav/202746106010.htm

在区块链上发行、管理、清算代币化金融工具的平台。强调代币交易的合规性和身份认证,可以配合 SEC 审核交易记录。执行代币交易合规性和追踪私人证券监管链方面,还有配合 SEC 审核交易记录的。

A platform for issuing, managing, and liquidating monetized financial instruments on the block chain.

(7)构建工具

(7) Build Tool

Set Protocol

https://www.block123.com/zh-hans/nav/886486409854.htm

创建、发行、赎回和管理一篮子代币资产的平台。刚刚获得 CraftVentures、Scott Belsky 和 DFJ 的投资。

Creates, distributes, redeems and manages a basket of token assets. You have just received investments in CraftVentures, Scott Belsky and DFJ.

(8)基金管理

(8) fund management

Fund Protocol

https://www.block123.com/zh-hans/nav/177646547064.htm

由 CoinAlpha 团队开发的基于以太坊的基金管理协议。

An Ether-based fund management agreement developed by the Coin Alpha team.

5、明星项目详细介绍

& nbsp;5 A detailed description of the Star Project

(1)MakerDAO介绍

(1) Introduction by MakerDAO

随着DeFi的不断繁荣,目前DeFi类项目的金融资产正在快速增加之中,据统计,已有超过250万个ETH被锁定在DeFi类应用中,而其中的一个项目就锁定了其中大约90%的份额,它就是目前DeFi领域中的大名鼎鼎的项目MakerDAO。

With the boom of DeFi, the financial assets of the DeFi category are currently growing rapidly, with more than 2.5 million ETHs being targeted for the DeFi category, one of which is about 90 per cent, the current major project in the DeFi field, MakerDAO.

MakerDAO使用场景是用户抵押自己的ETH,然后可以获得与美元1:1锚定的稳定币Dai。当用户想赎回自己的抵押的ETH时,只需要归还相应的Dai并支付利息费用即可。所以,你既可以把它理解为一个稳定币项目,也可以理解它为一个借贷类项目。

MakerDAO use scenes where the user mortgages its ETH and then gets a stable currency with the dollar 1:1 anchor. When the user wants to redeem the ETH, it just needs to return the corresponding Dai and pay interest. So you can understand it both as a stable currency project and as a loan type project.

是的,实际上MakerDAO扮演的是一个完全去中心化的银行角色,DAI则是这个银行所发行的去中心化稳定币。

Yes, actually, MakerDAO plays a completely decentralised banking role, and DAI issues a decentralised stabilization currency from this bank.

MakerDAO和USDT的区别

& nbsp; & nbsp;

那么,同样是稳定币,Dai与最近频频暴雷的USDT有什么本质的不同呢?

So what's the difference between Dai and the USDT of the most recent frequency of thunderstorms?

中心化的稳定币必须要质押1美元才能发行新的稳定币,这就免不了中心化的项目方存在,并且由他们掌控着巨额的质押资金,尤其在缺少监管的情况下,这种中心化管理的模式就注定免不了各种问题和争议出现。

The centralization of the stable currency would have to be pledged at $1 in order to issue a new stable currency, which would have prevented the existence of a centralized project party and their control over the huge amount of pledged funds, especially in the absence of supervision, and the centralization of the management model would have been doomed to problems and controversy.

而去中心化稳定币Dai的模式则完全不同,它是智能合约来质押用户的加密资产然后生成对应的稳定币,整个过程都在智能合约中自动运行,由于代码是开源的,运行是相对透明的,自然也就不用担心类似USDT被监管,被暴雷等等问题的发生了,这个优势是显而易见的。

The pattern of decentralizing and stabilizing the currency Dai is completely different. It is a smart contract to pledge the user's encrypted assets and then generate the corresponding stability currency. The whole process is run automatically in an intelligent contract. Since the code is open-sourced, it operates relatively transparently, it is natural not to worry about problems like USDT being regulated, thunderstorms, etc., which is obvious.

MakerDAO使用流程

MakerDAO uses

来看看MakerDAO的使用流程,如果我们想在MakerDAO上面进行抵押借贷的话,需要以下几个步骤来操作:

Look at the use of MakerDAO. If we want to make collateral lending on MakerDAO, the following steps will be required:

- 把自己的ETH发送到MakerDAO的智能合约上,这个智能合约被称为CDP,它可自动保存、锁定、归还用户的抵押资产;

- 系统会根据当时的ETH价格给你兑换相应数量的稳定币DAI,其中的兑换比例是可以由我们自己来选择的,但DAI的价值不可以超过抵押ETH价值的三分之二。你选择兑换的比例越高,则面临清算的风险越大,一旦发生清算,会有较高的罚金产生;

- 当你想要赎回ETH时,将借出的DAI归还给系统,同时支付一定的“利息费用”;

- 当系统确认你已经偿还了DAI和利息之后,会将之前抵押的ETH归还给你,相应的DAI会被系统销毁,至此整个借贷过程完成。

币价暴跌时MakerDAO是否会破产?

Will MakerDAO fail when the price of 估计很多朋友会问MakerDAO系统会不会因为ETH价格暴跌而破产? estimates that a lot of friends will ask whether the MakerDAO system will fail because of the fall in ETH prices? 它的运行机制里,当用户抵押的ETH不足以偿还借走的Dai时,系统会直接清算掉用户此前抵押的ETH,将暴跌的风险转嫁给用户来承担,这样也保证系统不会破产。并且,当清算发生时,系统会产生一笔额外的罚款,来处罚用户的过激借贷行为。而清算罚金则高达13%,这也就促使用户合理的去设置借贷比例,以避免因为币价的波动而被清算。根据MakerDAO官方的清算市场数据,目前市场的总体借贷抵押率为300%以上,远远高于150%的最低限制值,可见大多数用户都具备了较强的防清算意识。 In its operating mechanism, when the user mortgaged ETH is insufficient to repay the loaned Dai, the system directly clears the user's previously mortgaged ETH and shifts the risk of collapse to the user, thus ensuring that the system is not bankrupt. , and when liquidation takes place, the system creates an additional fine to punish the user for excessive lending. The 13 per cent liquidation fine also encourages the user to reasonably set the borrowing ratio to avoid being liquidated because of currency price fluctuations. According to MakerDAO's official liquidation market data, the overall mortgage rate in the market is now more than 300 per cent, well above the 150 per cent threshold, and most users appear to have a stronger sense of anti-liquidation.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论