OKEx欧意交易所App是一款全球领先的数字资产交易平台,提供多元化产品服务和安全保障,旨在满足全球用户的交易需求。OKEx欧意交易所App通过其专业的行情分析、实用的功能以及严格的安全措施,为全球用户提供了安全、便捷的数字资产交易服务。

The OKExEEXApp is a global leading digital asset trading platform that provides diversified product services and security to meet the global user demand for transactions. The OKExEEXApp provides secure and easy digital asset trading services to global users through professional profiling, practical functionality, and stringent security measures.

1、使用了强大的区块链技术,全方位的保障用户的资金和隐私安全。

1, using a powerful block chain technology that guarantees the financial and privacy security of users in all its aspects.

2、消息动态:全面及时的币种消息面供投资者参考交流,包含数千大V的预测分析及深度解读。

2, news dynamics: full and timely information in currency for investors' information exchange, with thousands of large V prediction analyses and in-depth interpretation.

3、提供包括k线图深度分析在内的多种功能,充分满足不同用户的需求。

4、信息渠道广独家分析准确的专业区块链财经app,提供便捷的信息交流渠道。

4; wide and exclusive access to information for accurate analysis of professional block chain finance, app. , providing easy information exchange channels.

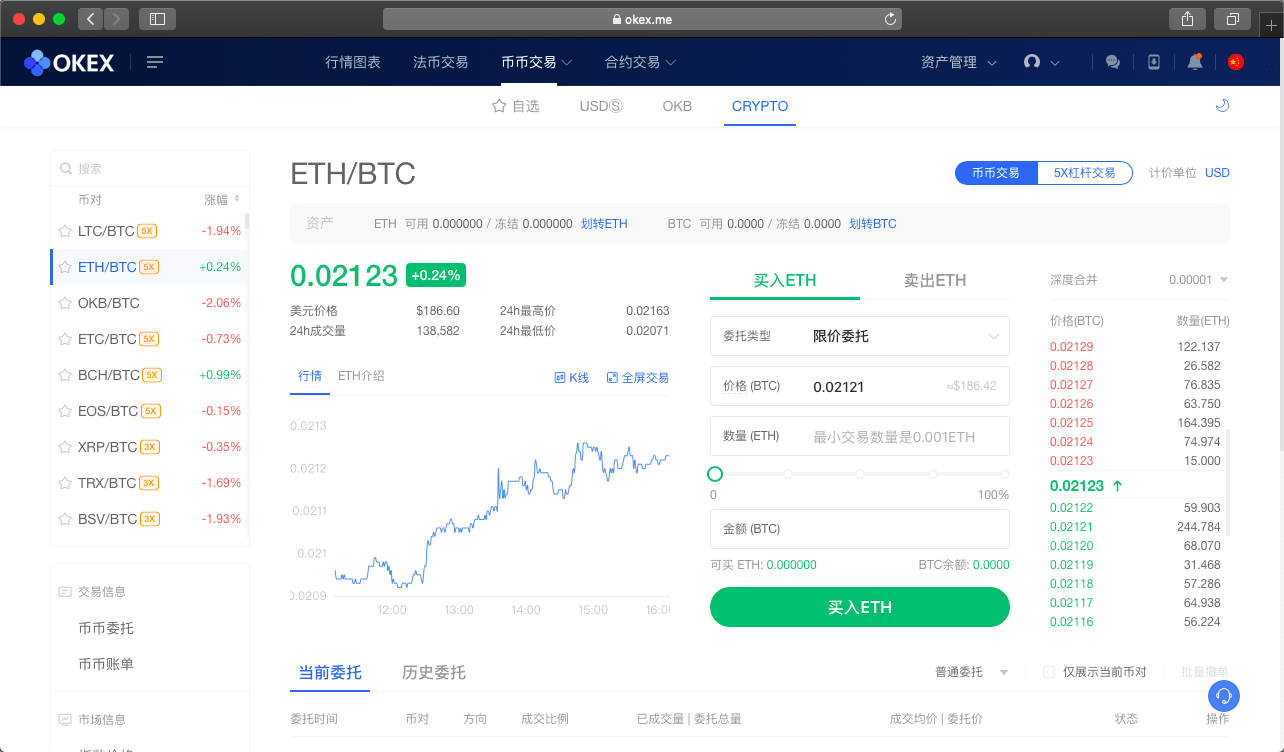

欧易OKEx是全球著名的数字资产交易平台之一

OeokEx is one of the world's famous digital asset trading platforms.

主要面向全球用户提供比特币、莱特币、以太币等数字资产的币币和衍生品交易服务

Exchange services for currency and derivatives of digital assets such as Bitcoin, Latcoin, etc., mainly for global users

1. 资金费用

1. Financial costs

资金费用的设计目的是为了调节系统多空平衡,其本质是类似于保证金交易的现货市场,买家和卖家定期交换资金费用。在永续合约中,没有交割日期。不到期就意味着合约价格可以永远和指数价格不一样。交易所无法通过到期结算的方式重置价格。交易者也不知道合约和现货之间的价格差在什么时候才会趋近于0。

The purpose of the fund fee, designed to regulate the system's emptyness balance , is essentially a cash market similar to a bond transaction, where buyers and sellers regularly exchange funds costs. In a permanent contract, there is no date of delivery. Non-maturity means that contract prices can always be different from index prices. An exchange cannot reset prices through maturity.

Okex的资金费用设计思路与BitMEX大同小异,都是对持仓资金在固定时间进行收费,不一样的是其交换周期是每24小时交换一次,而Bitmex是每8小时一次。由此可见,OKex对资金费用调节系统平衡功能的依赖相对较弱,bitmex则更容易通过资金费用锚定现货价格。但从另一个角度来看,在OKex上交易,用户的持仓成本相对较低。资金费用计算方法为:资金费用=仓位价值 * 资金费率

Okex’s financial cost design is much the same as that of BitMEX, which charges the funds held at a fixed time, unlike the exchange cycle, which is held every 24 hours, and Bitmex every 8 hours. Thus, OKex’s reliance on the Fund Cost Adjustment System’s balancing function is relatively weak, and bitmex is more likely to anchor spot prices through the cost of the funds. But from another perspective, the cost of storage is relatively low for users when traded at OKEX. The method of calculating the cost of the funds is: the cost of the funds = the value of the warehouse * the cost of the funds.

2. 自动减仓机制(结算+分摊机制)

2. Automatic warehousing mechanism (settlement + assessment mechanism)

Okex采用每日结算+分摊的机制保证系统盈亏平衡,其作用类似于Bitmex的自动减仓机制,但是实现流程存在较大差异。

Okex uses the daily settlement + assessment mechanism to ensure a profit/loss balance, which is similar to the Bitmex automatic warehousing mechanism, but there are significant variations in the process achieved.

3. 合理价格标记(标记价格)

3. Reasonable price mark (labelling price)

标记价格=现货指数价格+(基差)

Mark price = spot index price + (base spread)

基差=FutureMid-现货指数价格=(合约卖一价+合约买一价)/2-现货指数价格

Base spread = Futuremid - spot index price = (contract one price + contract one price) /2 - spot index price

Okex标记价格同时考虑了现货指数价格及基差的移动平均值,现货指数价格通过websocket实时获取指数成分交易所加权计算。因为通过基差的移动平均值加权计算了一段时间的基差,在大部分正常情况下,基本等于最新成交价;在出现异常用户动用非常大的资金想要操纵最新成交价时,标记价格又不会跟随最新成交价快速变动,而是将短时间内的异常波动平滑掉,从而降低了普通用户被异常爆仓的可能性。

Okex mark prices take into account both the spot index price and the moving average of the base difference, and spot index prices are weighted by the index component exchange via Websocket in real time. Because base differentials have been calculated over a period of time by weighting the moving average of the base spread, which, in most normal cases, is roughly equal to the latest offer; when unusual users use very large amounts of money to manipulate the latest offer, the mark price does not follow the latest exchange rate rapidly, but smooths out unusual fluctuations over a short period of time, thereby reducing the risk that ordinary users will be exposed to unusual bursting.

Okex的指数价格采用多家交易所的行情数据,计算出的加权价格,最终得出标记现货价格。

Okex's index prices were calculated using a number of exchange accounts, resulting in a weighted price that was eventually marked as spot prices.

需要注意的是,永续合约的未实现盈亏是基于标记现货价格进行估算的,这样可以避免合约价格波动造成用户爆仓的发生。

It is important to note that the unrealized gains and losses of the permanent contract are estimated on the basis of the marked spot price, which avoids the risk of a user crash as a result of contract price fluctuations.

1、用户根据对BTC价格趋势的判断决定多空方向,并根据时间长短选择合约类型。目前OKEX提供三种合约类型,分别是:当周,下周,季度。

1. Users determine multi-empty directions based on their judgment of price trends at BTC and select contract types according to length of time. Currently, OKEX offers three types of contracts: week, next week, quarter.

当周合约指在距离交易日最近的周五进行交割的合约;下周合约是指距离交易日最近的第二个周五进行交割的合约。季度合约是指交割日为3,6,9,12月中距离当前最近的一个月份的最后一个周五,且不与当周/次周/月度合约的交割日重合。

Quarterly contracts are the last Friday of the current month in mid-December and do not coincide with the day of the week/week/month contract.

2、用户选择合适的价格与数量成交。

2. Users choose the appropriate price and quantity.

用户购买合约时,所需的保证金为成交时刻与合约价值等值得BTC数量除以杠杆倍数。只有账户权益大于等于交易成功后保证金的数量,用户才能进行委托操作。

When a user buys a contract, the amount of security required is worth dividing BTC by a multiple of leverage, such as the time of the transaction and the value of the contract. The user can only commission a transaction if the interest in the account is greater than the amount of security after the transaction has been successful.

3、保证金

3. Bonds

在建立合约交易账户时,用户需要选择保证金模式,不同的保证金模式的交易保证金计算方法和风控制度不同。在无持仓无挂单时,即所有合约的保证金为0时,用户可以更改保证金模式。

When establishing a contractual transaction account, the user needs to choose a bond model, and the trading bond calculation method for different security models is have different controls. When there is no warehouse, i.e. when all contracts have zero security.

采用全仓保证金模式时,账户内所有仓位持仓的风险和收益将合并计算,全仓保证金模式下,开仓的要求是开仓后保证金率不能低于100%。

In the case of the full warehouse bond model, the risks and benefits of holding all the warehouses in the account would be calculated together and, under the full warehouse bond model, the opening requirement was that the post warehouse deposit rate should not be less than 100 per cent.

采用逐仓保证金模式时,每个合约的双向持仓将会独立计算其保证金和收益,只有开仓可用保证金大于等于开仓所需的保证金数量,用户才能进行委托。而逐仓保证金时,每个合约的开仓可用保证金可能不一致。

In the case of a warehouse-by-ware model, each contract’s two-way warehouse would independently calculate its bond and earnings, and the user would be able to commission the deposit only if the available deposit was greater than the amount required to open the warehouse. In the case of a warehouse-by-prior bond, the available bond for each contract might not be consistent.

4、成交后,则用户持有对应多空方向的仓位。

4. When a deal is made, the user holds a warehouse space corresponding to a multi-empty direction.

全仓保证金下,用户的账户权益将根据最新成交价增加或减少;全仓模式下,当用户的账户权益,10杠杆下,合约账户权益不足保证金的10%,20倍杠杆下,BTC合约账户权益不足保证金的20%时,系统将会对这个仓位进行强制平仓。而逐仓保证金下,用户某合约某方向的仓位的未实现盈亏将根据最新成交价增加或减少,而保证金将不会变化。当用户某合约某方向的仓位的保证金率小于等于10%(10倍杠杆)或20%(20倍杠杆)时,系统将会对这个仓位进行强制平仓。

Under the full warehouse bond, the user’s interest in the account will be increased or reduced according to the latest transaction value; under the full warehouse model, when the user’s interest in the account is less than 10% of the bond under 10 leverage, the contractual interest in the contract is less than 20% of the bond under the BTC contract account, the position will be compulsorily levelled. Under the full warehouse deposit, the user’s unrealized deficit in a location in a particular direction of the contract will be increased or reduced according to the latest offer, and the bond will not change.

5、持仓

5. Holding a warehouse

成交后,则用户持有对应多空方向的仓位。

When a deal is made, the user holds a warehouse space corresponding to a multi-empty direction.

6. 调整仓位

6. Relocation of warehouses

用户也可以根据市场行情,随时调整仓位,通过平仓锁定收益或止损,或继续开仓追增收益。

Users may also adjust their positions at any time in the light of market conditions, locking in gains or stopping losses, or continue to build up gains.

7、交割

Seven. Hand-off.

在交割日时,对未平仓的合约按交割指数,每点一美元的价格进行交割平仓。所有平仓产生的收益将汇总至用户合约账户的“已实现盈亏”项。

At the day of delivery, the unsaved contracts are delivered at a cut-off index of $1 a price.

交割完后,系统将穿仓用户损失在所有该合约净盈利的账户中按比例扣除。

Upon completion of the delivery, the system deducts the losses of users in the warehouse on a pro rata basis from all the net profit accounts of the contract.

8、清算

8. Liquidation

清算完后,所有已实现盈亏将汇总至账户余额。

After liquidation, all realized gains and losses will be consolidated into the account balance.

9、结束

9. CONCLUSION

该合约结束,交易所发布新合约。

The contract is over and the exchange issues a new contract.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论