来源 | 链得得App(微信ID:ChainDD)

Source: chained to App.

USDT出现以来,作为数字货币稳定价值和交易货币的功用,令其交易额长期处于全球逾千种数字加密货币交易量的最前端,对数字货币市场的影响力显著且深远。与此同时,作为一个去中心化,节点高度自治的市场信仰中,中心化发行的USDT及其发行公司Tether,始终存在于各色争议当中。

Since the USDT’s emergence, as a digital currency’s ability to stabilize its value and as a traded currency, it has long been at the forefront of more than a thousand digitally encrypted currency transactions worldwide, with significant and far-reaching implications for the digital currency market. At the same time, as a decentralized, highly autonomous market belief, the centralized USDT and its issuer, Teth, have always been in a variety of disputes.

USDT疯狂增发到底为了什么,1:1对应的美元账户在哪里,如何被审计?USDT持有用户是否能兑换出相应面值的美元?Bitfinex和Tether是什么关系,是否真如爆料内容一样是推动比特币阶段疯涨的幕后黑手?

What is the reason for the crazy USDT increase, where is the 1:1 counterpart dollar account and how is it audited? Is the user of the USDT able to exchange the dollar for the corresponding face value? What is the relationship between Bitfinex and Tether?

这些关键的问题都等待解答。

These key questions await answers.

2月8日,Medium上一位名为Bitfinex'ed的爆料人发表了Tether和Bitfinex高管的公开录音,把身陷“超发”和“操纵市场”风波的Tether再次拉回舆论视线。链得得App研究团队随后展开了一系列调查。

On February 8, one of Medium's top informants, Bitfinex'ed, published a public recording of Tether and Bitfinex executives, trapped in “ super-haired & & & rdquao; market manipulation & & rdquao; and the wind wave, Tether, again pulled back public opinion.

链得得APP获取并编译的爆料人公开录音显示:Bitfinex和Tether的高管Phil Poter在谈话中表示:“我们之前和银行也出过一些问题,但都能够找到方法去解决,例如注册新的公司账户或者转到空壳公司。在比特币行业大家都会有各种技巧来达到目的。由于六个月前爆发的兆丰国际银行的丑闻,这次我们不能用以往的方法来处理。台湾现在在严格地审查境外金融流程。”

The chain was captured and compiled by the APP with the public recording of the blasters: Bill Potter, the top manager of Bitfinex and Tether, said in a conversation that: “ we had problems with the banks before, but we were able to find solutions, such as registering new company accounts or transferring them to shell companies. Everyone in the Bitcoin industry will have a variety of skills to achieve their objectives. As a result of the scandal that broke out six months ago, we can't deal with it this time in the way we did. Taiwan is now scrutinising offshore financial processes. & & rdquo;

USDT(泰达币)是Tether公司发行的数字货币,尽管USDT也是数字货币的一种,但是与比特币这种去中心化都数字相比又有极大的不同。USDT号称严格按照“美元本位”的理念发行,每发出一个USDT,都会有一美元储存在银行账户中,这极大的确保了USDT的稳定性,币值会围绕着美元的价格上下浮动。

The USDT is a digital currency issued by Tether, and although it is also a digital currency, it is very different from the decentralised figure of Bitcoin. The USDT calls for strict compliance with “ the dollar local & rdquao; and the idea that each release of a USDT is stored in a bank account with a dollar, which greatly ensures the stability of the USDT, the value of which floats around the dollar price.

随着全球范围内对数字货币交易政策的监管越来越严格,多国政府已经严禁交易所内使用法币进行数字货币的交换。在这种情况下,几乎等同于美元的USDT成为了进入币市的入场券,如果想要购买数字货币,可以先购买一定数量的USDT,等待合适时机抄底,用USDT购买数字货币;同样,抛售数字货币时先把数字货币换成USDT,再提现变成相应的法币。

As the global regulation of digital currency transactions becomes more stringent, many governments have banned the exchange’s use of French currency for digital currency exchange. In this case, USDT, which is almost equivalent to the dollar, becomes an entry ticket into the currency market, can buy a certain amount of USDT before purchasing digital currency, waiting for the right time to buy digital currency from USDT; similarly, when selling digital currency, it is replaced by USDT, which then turns it into a corresponding French currency.

这种操作模式下,比单独用法币购买数字货币更为稳妥,而Tether和USDT也成为了链接传统银行和数字货币世界的重要一环。

This mode of operation is more secure than the purchase of digital currency in a single French currency, and Tether and USDT have also become important links to the world of traditional banks and digital currencies.

根据Coinmarketcap.com数据显示,市场上流通的USDT数量共有22.23亿个,目前价格为1美元,也就是说Tether共发行了价值22.23亿美元的USDT。如果按照Tether的合法操作模式,其账户中应至少有22亿美元的存款以对应等值发行的USDT。

According to Coinmarkcap.com, the number of USDTs in circulation on the market is 2,223 million, with a current price of $1, which means that Teth has issued US$ 2.223 billion. If, according to Tether’s legal operating model, there should be at least US$ 2.2 billion in deposits in its accounts issued in equivalent terms.

这就回到了最开始提到的超发问题,面对公众、用户、以及监管机构的质疑,Tether目前并未通过公开渠道提供证据来证明这笔储备金的存在。

This goes back to the problem of excesses that was first mentioned and, in the face of public, user and regulatory challenges, Tether does not currently provide evidence of the existence of this reserve through public channels.

据链得得APP调查了解,作为入场“币市”的通行证,USDT目前活跃在各大交易平台上,看似背靠美元的加持,实质上并没有人清楚每个USDT对应的美元都在哪里。

According to the APP investigation, as a pass for entry & ldquao; currency & rdquao; and USDT is currently active on major trading platforms and appears to be held on the back of the dollar, and in essence no one knows where each dollar corresponds to.

由会计师事务所Friedman LLP公司出具的审计报告显示,截至2017年9月15日,Tether以及Tether相关公司的银行账户共有4.43亿美元以及1590欧元(约1970美元)。根据Coinmarketcap.com数据,2017年9月15日USDT在市场上流通的发行总数所对应的美元价值共计4.22亿美元。

The audit report issued by Friedman LLP, a firm of accountants, showed that, as at 15 September 2017, Tether and Tether-related bank accounts amounted to $443 million and Euro1590 (approximately US$ 1970).c According to Coinmarkcap.com data, the total circulation of USDT on the market as at 15 September 2017 amounted to US$422 million.

如果Friedman公司出具的审计报告准确的话,9月15日,Tether账户的资产与USDT发行的数量是吻合的。但值得注意的是,报告中的银行名称和相关公司名字并未披露。

If the audit report issued by Friedman was accurate, the assets in Tether's account matched the quantity of USDT issued on 15 September; it is noteworthy, however, that the bank name in the report and the name of the related company were not disclosed.

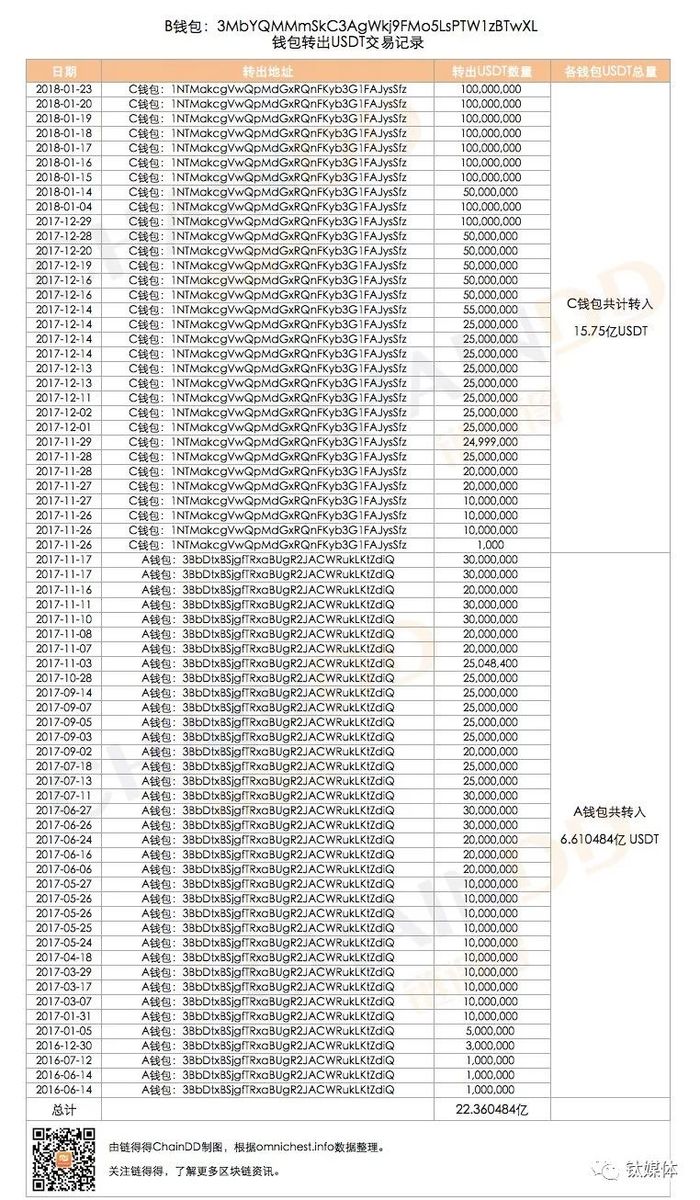

经链得得APP调查发现,上图报告中的两个Tehter公司钱包地址从2016年至今一直在进行巨额USDT的交易,并且在2017年11月26日之后,又出现了一个新的交易USDT钱包地址:1NTMakcgVwQpMdGxRQnFKyb3G1FAJysSfz。为方便描述,我们把报告中的两个钱包地址分别以A和B来表示,由链得得APP新发现的钱包地址用C来表示。

A钱包:3BbDtxBSjgfTRxaBUgR2JACWRukLKtZdiQ

A Wallet: 3BbDtxBSjgfTRxaBUgR2JACWrukLKtZdiQ

B钱包:3MbYQMMmSkC3AgWkj9FMo5LsPTW1zBTwXL

B Wallet: 3MbyQMMSkC3AgWkj9FMo5LsPTW1zBTwXL

C钱包:1NTMakcgVwQpMdGxRQnFKyb3G1FAJysSfz

C Wallet: 1 NTMakcgVwQpMdGxRQnFKyb3G1FAJysSfz

链得得APP梳理了B钱包自2016年6月14日至今发行的USDT数量,共计22.360484亿个USDT,与目前市面上USDT的数量相当。

The chain made it possible to comb the number of USDTs issued by the B wallet since 14 June 2016, amounting to 2,236,044.84 million USDTs, corresponding to the current number of USDTs on the market.

2016年6月14日-2017年9月15日,B钱包共转入A钱包4.31亿个USDT,这个数字和9月15日Tether的审计报告是吻合的。据目前可供追溯的源头来看,B钱包是Tether平台发行USDT的最初钱包,包括增发的USDT大多来源于此。

On 14 June 2016 and 15 September 2017, B wallets were transferred to A wallets for a total of 431 million USDTs, a figure that coincides with the 15 September audit report by Tether. According to the current sources, the B wallets are the original wallets for the Tether platform for the release of USDTs, including most of the additional USDTs.

2016年6月14日-2017年11月17日,B钱包共转入A钱包6.610484亿个USDT。

On 14 June 2016 and 17 November 2017, the B wallet was transferred to 661.084 million USDTs.

2017年11月26日,C钱包被创建,自此之后,B钱包便停止了向A钱包中转入USDT,转而将接下来的USDT通过C钱包转出。从2017年11月26日至今,B钱包通过C钱包共转出15.75亿个USDT。

On 26 November 2017, the C Wallet was created, and since then the B Wallet has stopped transferring USDT to the A Wallet, and then transfers the next USDT through the C Wallet. From 26 November 2017 to the present, B Wallet transferred a total of 1,575 million USDTs through the C Wallet.

目前A钱包USDT的数量为零,其最后两笔交易是在2017年12月19日,分别转出了32642.27137935个USDT和166.55个EURT至C账户,C账户目前USDT余额为960153.48。也就是说在继钱包B与A之后,目前发行USDT的官方活跃主钱包是C。市面上此刻所有发行的USDT都由这个钱包里的USDT对外交易划拨而出。

At present, the number of USDTs is zero, and the last two transactions were made on 19 December 2017, with 32642.273735 USDTs and 166.55 EURTs to C accounts, with the current balance of USDT 960153.48. This means that the official active wallets that are currently being issued are Cs. All USDTs issued on the market at this time are allocated from the USDT external transactions in this wallet.

根据USDT市值数据显示,自2017年9月15日之前,USDT市值(等同于总发行额)稳定保持在4.22亿美元附近。时间往前倒推5个月,在2017年4月份,Tether在台湾的银行业务终止,所有接入Tether的国际转账被台湾的银行拒绝,同时根据市值数据来看,USDT第一次大规模的增发也是从2017年4、5月的时候开始。

在2017年9月15日审计报告发布后,USDT在接下来的一个半月之内暂停增发,从2017年10月28日开始,又开始几乎疯狂的增发USDT。按照Tether的说法,每发行一个USDT代表一美元储备,USDT的数量从9月15日的4.22亿一路狂飙,截至2018年2月21日,据链得得App统计,市场上流通的USDT共有22.19亿个,也就意味着Tether的账户中需要有22.19亿美元的储备。如此大规模增发的背后,Tether公司目前并没有相关的证据证明账户的存款数额和相应的变动情况。

Following the issuance of the audit report on 15 September 2017, USDT suspended its increase for the following one and a half months, starting on 28 October 2017, and began to produce almost insanely additional USDT. According to Tether, each release of USDT represents a dollar reserve, the number of USDTs amounted to 422 million on 15 September, and, as of 21 February 2018, there were 2,219 million USDTs in circulation on the market, meaning that Tether needed a reserve of $22.19 billion in its account. Following this massive increase, Tether currently has no relevant evidence to support the amount of deposits in the account and the corresponding changes.

换句话说,从2017年9月的4亿美元市值,到2018年2月的22亿美元市值。在不到五个月的时间内,要满足增发后等额USDT背后支撑的美元数量,Tether必须多储备18亿美元。这种规模的现金储备量是否能完成?这点我们不得而知。

2018年1月,Tether的前审计公司Friedman LLP已经宣布停止合作,目前没有审计公司表示正对Tether财务情况进行审计服务。其也至今没有再公开过应公开数据。

In January 2018, the former audit firm of Tether, Friedman LLP, had announced that it had ceased its cooperation, and no audit firm had indicated that it was performing audit services on Tether's financial situation.

Tether在承担了如此大的公众流通数字资产信誉背书责任下,却没有审计,也迟迟不公开最新的储备信息和发行信息,这显然不是在一个去中心化、强调过程和操作透明的市场中应有的可靠形象。

With such a large endorsement responsibility for the credibility of digital assets in public circulation, however, there was no audit and there was a delay in disclosing up-to-date reserve and distribution information, which was clearly not a reliable image to be given in a decentralized, process-oriented and transparent market.

在操纵比特币价格的质疑中,Bitfinex和Tether之间的裙带利益关系最为受关注。

The nepotism between Bitfinex and Tether received the most attention in the challenge of manipulation of the Bitcoin price.

2015年2月USDT发布时,比特币期货交易量最大交易平台bitfinex宣布支持USDT交易。随后竞争币交易平台Poloniex交易所也支持USDT。USDT的发行和交易使用的是Omni(原Mastercoin)协议,而Omni币可以说是市面上的第一个基于比特币区块链的2.0币种。所以USDT的交易确认等参数是与比特币一致的。根据Tether的CTO及联合创始人Craig Sellars 称,用户可以通过SWIFT电汇美元至Tether公司提供的银行帐户,或通过Bitfinex交易所换取USDT。

At the time of the release of the USDT in February 2015, bitfinex, the trading platform with the largest volume of Bitcoin futures, announced its support for the USDT transaction. The subsequent competition currency exchange Polonix also supported the USDT. The USDT was issued and traded using the Omni (formerly Mastercoin) agreement, while Omni is the first on the market to be based on the Bitcoin block chain of 2.0. So the parameters of the USDT transaction confirmation are consistent with Bitcoin. According to Terry's CTO and its co-founder, Craig Sellars, users can wire the United States dollar through SWIFT to a bank account provided by Tether, or through the Bitfinex exchange for USDT.

根据链得得2月21日全球数币交易量24小时排行榜Top30交易所数据显示,Bitfinex以95.84亿人民币交易量位于第四位。这家当前全球最大数字货币交易所之一的Bitfinex和Tether存在高度人事关联。

According to the Top30 Exchange, which ranked 24 hours on February 21st in the chain, Bitfinex is in fourth place for 9,584 million yuan. Bitfinex and Tether, one of the world’s largest digital currency exchanges, have a high degree of personal connection.

根据Bloomberg提供的海外数据查询,2012年在维京群岛注册的一家名为iFinex Inc.的公司,CEO为Mr. Jean-Louis van der Velde。这家iFinex Inc.公司目前运营着Bitfinex的业务,并显Bitfinex公司成立于香港,地址是1308 Bank of American Tower。

According to an overseas data search provided by Bloomberg, a company registered in the Virgin Islands in 2012, known as iFinex Inc., the CEO is Mr. Jean-Louis van der Velde. The iFinex Inc. currently operates Bitfinex and is known as Bitfinex, established in Hong Kong at 1308 Bank of American Tower.

在香港官方查询网站上可以看到,Bitfinex公司2013年3月8日注册在香港,注册地址也同为1308 Bank of American Tower。但在2014年4月29日,Bitfinex公司更名为Renrenbee。 而Renrenbee公司的官网显示,这是一家FinTech公司,目前正在开发并未投入运营。

However, on 29 April 2014, Bitfinex changed its name to Renrenbee, a network of officials of Renrenbee, which is a FinTech company and is currently not operational.

而Tether也在香港有注册公司,公司董事也是这位Van Der Velde先生。

Tether also has a registered company in Hong Kong and its director is Mr. Van Der Velde.

综合公开信息发现,Bitfinex和Tether的CEO、CFO、以及首席战略官等核心人物都高度一致。所以,准确地说Bitfinex和Tether几乎是同一批人掌握的公司。

A combination of public information found that the core figures of Bitfinex and Tether's CEOs, CFOs, and the Chief Strategic Officer were highly consistent. So, to be exact, Bitfinex and Tether are almost identical companies.

解构这两家公司的权力关系后,回头来看Tether利用增发协同Bitfinex操纵比特币价格的质疑在数据追踪上是否有体现。

When the power relationship between the two companies was deconstructed, it turned to the question of whether Tether's use of increased coordination with Bitfinex to manipulate Bitfinex's price represented data tracking.

今年一月,在一份匿名报告中显示,根据记录,48.8%的比特币价格上涨与USDT的增发事件有关,在已记录的91起USDT增发中,新的USDT转移到Bitfinex的钱包两小时内,比特币的价格开始上涨。

In January of this year, an anonymous report showed that 48.8 per cent of the price increase in Bitcoin had been recorded in connection with the increase in USDT, and that the price of Bitcoin had begun to rise within two hours of the transfer of the new USDT to Bitfinex's wallet, out of 91 USDT surges recorded.

Tether 分析报告 该作者预测如果USDT和Bitfinex存在可疑行为的话,BTC的价格将会下跌30%-80%。这一预测是准确的,在2月初,比特币的价格一路跌至6400美元。

The author predicted that BTC prices would fall by 30-80% if there were suspicious behaviour on the part of USDT and Bitfinex. This forecast is accurate, and in early February Bitcoin prices fell down to $6,400.

理论上讲,USDT是独立于比特币市场发行且与美元挂钩的数字货币,若无人为操纵,增发等价美元的USDT并不会驱使比特币市场的涨跌。要证明USDT的增发是否操纵了比特币价格的上涨,首先要确定USDT是什么时候增发的,以及增发之后比特币市场发生了哪些变化。

Theoretically, USDT is a digital currency issued independently of the Bitcoin market and pegged to the dollar, and if it is not manipulated, an increase in the dollar equivalent will not drive the Bitcoin market up or down. To prove whether the increase in the USDT has manipulated the price increase in Bitcoin, it is first necessary to determine when the USD was increased and what changes have occurred in the Bitcoin market since the increase.

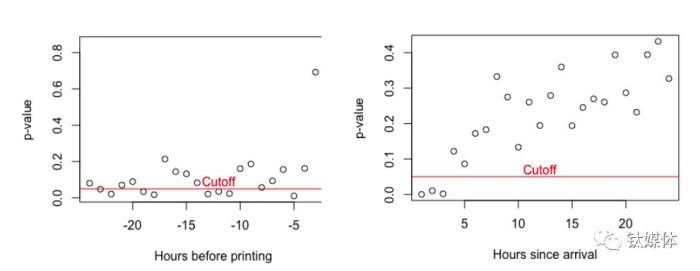

在链得得APP获得的这份匿名报告中,作者使用了Kolmogorov-Smirnov test(柯尔莫诺夫-斯米尔诺夫检验)方法来分析变量是否符合某种分布,并对USDT增发和比特币价格变动之间有无显著差异进行了比较。p值越趋近于0,表示二者的关联度越低,p值越趋近于1,则表示而这关联度越高。若p值大于0.05则认为是有显著性差异。通过USDT增发前后比特币价格数据进行对比,可以明显看到,在USDT增发前数小时,这一比率是非常平稳的,但是在USDT增发后数小时内,比特币的与USDT的相关性明显上升。报告的验证结果也表示USDT增发和比特币上涨存在关联。

In the anonymous report obtained by the APP chain, the author used the Kolmogorov-Smirnov test (Kolmonov-Smirnov test) method to analyse whether the variables were in a certain distribution and to compare whether there were significant differences between USDT increases and Bitcoin price changes. The closer the p value is to zero, the closer the link is to one, the closer the p value is to one. If the p value is greater than 0.05, it is considered to be a significant difference. A comparison of the USDT price increases before and after USDT increases, it is clear that the ratio is very flat in the hours before the USDT increases, but within hours of the USDT increases, the higher the correlation between the USDT and the USDT is also evident.

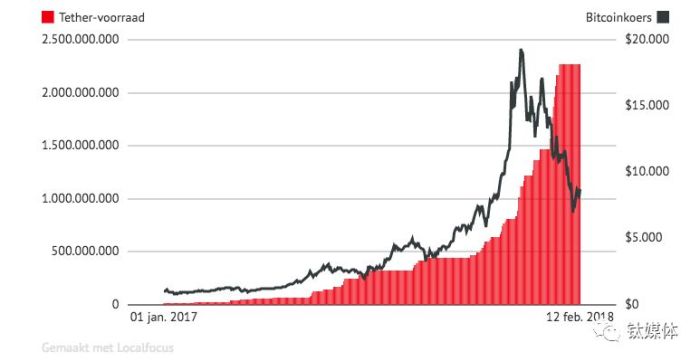

如果说这些分析模型难以理解,可以通过下图直观的看出,比特币的价格和USDT发行量的关系(黑线代表比特币价格,红色面积代表USDT发行量)。从2017年4月起到2017年12月底,USDT疯狂增发的同时,比特币也在疯狂的上涨。

“这已经越来越令人担忧了。”旗下拥有几个虚拟货币对冲基金的Pantera Capital联合首席投资官Joey Krug说,“这意味着大量从去年12月到今年1月份发行的USDT可能都不是真的。”

& & ldquo; this is becoming increasingly worrying. & & & & & & & ; & & & & & & ; & & & & & ; & & & & & & & & & ; & & & & & & & & ; & & & & & & & & ; & & & & & ; & ; & & & & ; & ; & & & & ; ; ; & ;

如果Tether发行的每一个USDT都有相应的美元在背后作为支撑,那么这种巨大的涨幅可以视为在数字货币疯狂上涨的阶段,市场对作为交易媒介的USDT相应需求的增加。

If each of the USDTs that Tether issues is backed by a corresponding dollar, this huge increase can be seen as an increase in the corresponding market demand for the USDT as a medium of trade during a period of frenzy in digital currency.

但如果这些USDT是没有相应美元资产支撑而凭空创造出来的,Tether疯狂超发十几亿美元USDT,则不需要任何成本,通过释放这些USDT给众多投资者,转用投资人购置USDT的资金,用这些钱或直接用增发的USDT大量买入比特币等数字货币资产,迅速推动对应数字货币市场的流动性,拉高比特币等数字货币价格,寻找合适的机会高位出货。

But if these USDTs are created in vain and without the support of the corresponding dollar assets, however, Tether is frenzy in excess of US$ 1 billion, without any cost, by releasing these USDTs to a large number of investors, diverting funds from the investors to purchase USDT, buying large quantities of digital monetary assets, such as bitcoins, either from them or directly from the increased USDT, rapidly driving the liquidity of the corresponding digital currency market, and by taking up digital currency prices, such as the Lagobitco currency, in search of suitable opportunities for higher delivery.

在这个过程中,Tether利用Bitfinex来进行大规模的比特币和其余数字货币的交易,在增发USDT推动数字货币价格变动之后寻求溢价。

In the process, Tether used Bitfinex for large-scale Bitcoins and the rest of the digital currency transactions, seeking a premium after the increase in the USDT facilitated a change in the price of the digital currency.

正如同Tether最初推出USDT承诺储备对应等值美元资产以保证币价稳定的那样,如今其最大的信任危机仍停留在其美元账户资产和USDT发行数量无法提供实时透明信息的环节之上。

As was the case with Tether's initial roll-out of the USDT commitment to reserve United States dollar equivalent assets to ensure currency stability, its biggest crisis of confidence remains in the absence of real-time transparent information on its dollar account assets and on the volume of USDT releases.

2月20日,根据链得得APP报道,荷兰三大银行之一的荷兰国际集团ING确认Bitfinex在该银行有账户,并愿意服务这家公司。

On 20 February, according to APP reports, the Dutch international grouping ING, one of the three Dutch banks, confirmed that Bitfinex had an account with the bank and was willing to serve the company.

ING发言人Harold Reusken也证实Bitfinex和Tether的确在ING有账户,但是ING没有提供Bitfinex账户的其他信息。自从去年4月台湾的银行以及富国银行切断和Tether的业务往来之后,Tether存放超过22亿美元的神秘银行账户去了哪里一直是个谜。如今关联公司Bitfinex被爆出在荷兰的账户,Tether的神秘账户是否也与ING相关,引人遐想。

ING spokesman Harold Reusken also confirmed that Bitfinex and Tether do have accounts at ING, but ING did not provide any other information on Bitfinex’s account. Since last April, when banks in Taiwan and rich countries cut off business with Tether, Tether’s secret bank account of over $2.2 billion has been a mystery.

面对步步紧逼的舆论追踪,ING银行近期公开表示“客户不能在ING购买或出售比特币,但我们不会拒绝在交易所进行加密交易的客户(例如通过iDEAL)。如果有迹象表明客户可能犯洗钱罪,欺诈或任何其他原因不以诚信行事,ING将会冻结客户的账号并终止银行关系。”

In the face of aggressive public opinion tracking, ING Bank has recently publicly indicated “ customers cannot buy or sell bitcoins at ING, but we will not refuse to sell encrypted transactions on the exchange (e.g. via iDEAL). If there are indications that a client may commit a money-laundering offence, fraud or any other reason not to act in good faith, ING will freeze the account number of the client and terminate the bank relationship.

据彭博社消息,美国商品期货委员会(CFTC)在2017年12月6日向Bitfinex和Tether发出传票。在一份两家公司官方回应的电子邮件声明中,Bitfinex和Tetherx的态度是,“我们不对任何此类要求发表评论”。同时,监管的另一方CFTC发言人也拒绝就有关数字货币业务的问题发表评论。至于为什么CFTC向Bitfinex和Tether发出传票,几乎没有公开的信息。

According to Bloomberg, the United States Commodity Futures Commission (CFTC) issued summonses to Bitfinex and Tether on 6 December 2017. In an official e-mail statement from two companies, Bitfinex and Tetherx took the attitude of “ we did not comment on any of these requests & rdquo; and, at the same time, the other regulatory CFTC spokesperson refused to comment on issues related to digital currency operations.

一位不愿透露姓名的币圈资深人士告诉链得得APP,其实在近两个月前就已经接到消息,USDT将会出问题。因此该人士和其周边数字货币资深投资人都已迅速清空自己的USDT资产,并不再以USDT作为媒介来交易其余数字货币。尽管USDT这样中心化的数字交易货币始终存在超发、滥发、流通和价值背书不透明等种种问题,它却依然成为眼下除比特币、以太坊之外交易量最大的数字货币,且持续影响着数字货币市场的价格波动。

As a result, both the individual and his neighboring senior investors in digital money have quickly emptied their own USDT assets and stopped using USDT as a medium for trading the rest of the digital currency. While a centralized digital currency such as USDT has been subject to problems of excess, excessive hair, circulation, and lack of transparency of value endorsements, it continues to be the largest digital currency in the world, with the exception of Bitcoin, and beyond, and continues to influence price volatility in the digital currency market.

“即便USDT倒了,我相信迅速就会有新的替代者进场接班。据我所知,现在着手在做USDT这样事的团队就有好几家,国内国外都有。”该人士向链得得APP表示。(本文独家首发链得得App,未经授权禁止转载)

& & ldquao; if the USDT falls, I'm sure that a new replacement will soon arrive. As far as I know, there are now several teams working on the USDT, both within and outside the country. & rdquao; this person showed the chain to the APP.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论