比特币短期持有者(STH)的实现价格正在上涨,表明随着价格在 6 月 10 日突破 70,000 美元,BTC 的上涨趋势“将继续”。

bitcoin short-term holder (STH) realization prices are rising, indicating that the upward trend in BTC

When

这一群体主要由在今年 1 月美国现货比特币 ETF获批之前和之后购买 BTC 的人组成,当时 BTC 价格已于3 月份突破 69,000 美元的历史高点。

This group is composed mainly of those who purchased BTC before and after the approval of the US current

Van Straten 利用市场情报公司 Glassnode 的数据指出,STH 的实际价格一直稳步上涨,接近 64,000 美元,表明比特币在过去 18 个月中呈上升趋势。

Van Straten, using data from market intelligence company Glasnode, notes that the real prices of STH have been rising steadily, close to $64,000, indicating an upward trend in Bitcoin over the past 18 months.

这一指标提供了关键支撑,比特币在 5 月初就测试了这一水平。STH 实际价格在过去一周上涨了 1.5%,表明短期投机活动有所增加。

This indicator provides the key support, which Bitcoin tested in early May. STH real prices have risen by 1.5 per cent over the past week, indicating an increase in short-term speculation.

只要比特币在未来几个月内保持在 64,000 美元以上,比特币价格的长期前景将保持看涨,因为该水平充当重要的支撑区域。

As long as Bitcoin remains above $64,000 in the coming months, the long-term prospects of bitcoin prices will remain high, as this level serves as an important supporting area.

截至本文发表时,BTC 的交易价格为 70,090 美元,与其在复苏道路上面临的阻力相比,其在下行方面获得了强劲支撑。

At the time of publication of this paper, BTC's transaction price was $70,090, which was strongly supported down the road compared to the resistance it faced on the recovery path.

IntoTheBlock 的数据证实了这一点,其价格内外 (IOMAP) 模型显示,69,000 美元左右的价格的直接支撑位是之前约 130 万美元被超过 222 万个地址购买的地方。

This is confirmed by Into TheBlock data, whose price inside and outside (IOMAP) models show that prices around $69,000 are directly supported by earlier purchases of about $1.3 million by more than 2.2 million addresses.

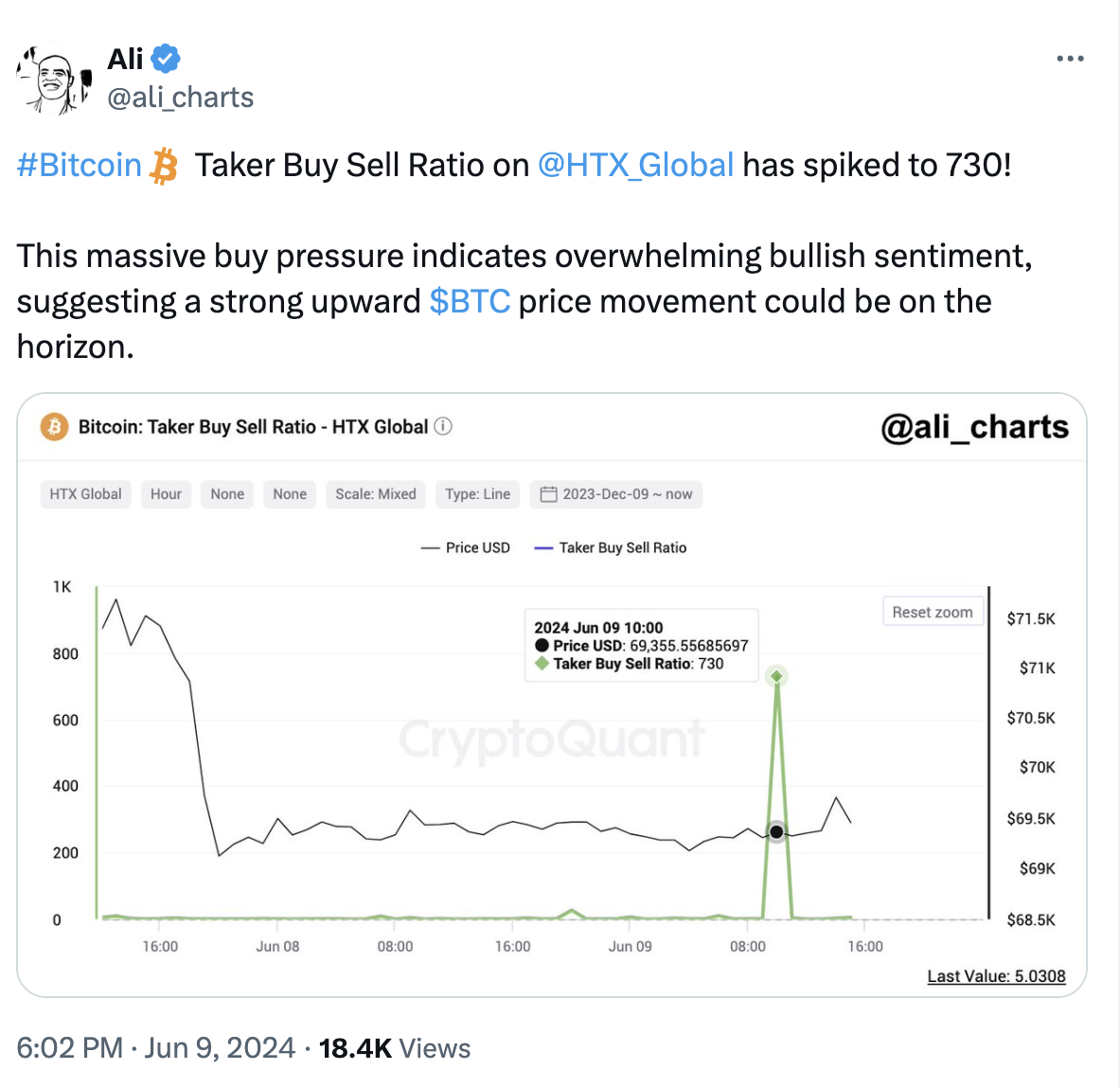

任何试图压低价格的行为都可能遭到这群想要增加利润的投资者的大力购买。CryptoQuant 的附加数据显示,HTX 加密货币交易所的 Taker 买卖比例激增。

Any attempt to lower prices is likely to be purchased vigorously by these groups of investors who want to increase profits. CryptoQuant’s additional data show that the share of HTX’s encrypted currency exchange taker’s sales has increased dramatically.

接受者买卖比率是交易员用来衡量市场情绪和潜在价格走势的关键指标。比率高于 1 表示接受者买入多于卖出,表明看涨情绪,而比率低于 1 则表明相反。

The recipient-buyer ratio is a key indicator of market sentiment and potential price trends used by traders. The ratio is higher than 1. It means that the recipient buys more than sells, indicating an increase in sentiment, while the ratio is lower than 1.

独立交易员阿里·马丁内斯 (Ali Martinez) 观察到该比率已飙升至 730,这是一个罕见的现象,表明 HTX 交易所的买方压力异常强劲。

Ali Martinez, an independent trader, observed that the ratio had soared to 730, which was a rare sign of exceptionally strong buyer pressure on the HTX exchange.

总体而言,接受者买卖比率的飙升表明,目前有相当数量的投资者正在购买比特币,以期价格进一步上涨。购买活动的激增往往先于价格大幅上涨。

Overall, a sharp rise in the recipient-buyer ratio suggests that a significant number of investors are now buying bitcoins with a view to further price increases. The surge in purchasing activity is often ahead of a substantial increase in prices.

在另一篇 X 帖子中,马丁内斯发现比特币网络上每日活跃地址数量激增,打破了“自 3 月 5 日开始的下降趋势!他分享了 Santiment 的一张图表,显示过去 24 小时内比特币区块链上活跃地址增加了 765,480 个。

In another X post, Martinez discovered a surge in the number of daily active addresses on the Bitcoin network, breaking the “declining trend since March 5th!” He shared a chart of Santiago showing an increase of 765,480 active addresses in the block chain of Bitcoin over the past 24 hours.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论